NBFCs now sit at the centre of India’s lending story. They reach homes, shops, farms, and small towns where many banks still struggle to serve. Over time, they’ve become a steady support system for people who need quick and simple credit. India is growing fast, and with this growth comes a huge need for funds. NBFCs help fill that gap by giving loans for homes, vehicles, tiny shops, small factories, and everyday needs.

Here’s the thing India’s credit demand is rising far faster than banks alone can handle. That’s why NBFCs matter so much. They move quickly, understand local needs, and work in areas with limited access to formal banking. But this space is also changing. Tech is reshaping how people borrow. Rules are getting tighter to make lenders act responsibly. And new fintech players are stepping in with fresh ideas.

The future of NBFCs depends on how well they use digital tools, follow NBFC Compliance rules, and keep their NBFC Registration strong. These three pieces will decide which NBFCs grow and which fall behind. The next decade will bring huge chances and tough challenges, and the NBFCs that adapt early will lead the way.

What NBFCs Actually Do

NBFCs help people who need loans for homes, shops, farms, vehicles, education, or daily expenses. They also support small businesses that banks often overlook. Because of this reach, NBFCs have become one of the strongest pillars of India’s credit market.

By 2023, NBFCs held 19.9 percent of India’s total credit share.

Source: https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=1254

This growth is possible because NBFCs follow clean NBFC Compliance rules and more new firms get NBFC Registration to join the market. NBFC Registration helps build trust, while NBFC Compliance keeps operations safe and stable.

The Current Landscape

NBFCs operate in many lending areas gold loans, home loans, vehicles, MSME credit, microfinance, and more. Their combined loan book crossed ₹31 lakh crore in 2023.

The sector has also faced shocks. Big failures like IL&FS and DHFL forced the RBI to tighten NBFC Compliance rules. Many NBFCs had to improve audits, reporting, and risk checks. Some smaller players even exited because the cost of following strict NBFC Compliance was too high.

At the same time, fresh NBFC Registration applications continue because demand for credit keeps rising. Safe growth now depends on both strong NBFC Compliance and well-managed NBFC Registration from day one.

Trends Shaping the Future of NBFCs

Digital-First Lending

Most NBFCs are shifting their work online. Loan applications, credit checks, approvals, and even collections happen digitally. This cuts cost and speeds things up. It also helps NBFC Compliance because digital systems store clear records and reduce risk.

This has also led to a rise in digital-first NBFC Registration.

Embedded Finance

More apps and online stores now offer loans at checkout. This is embedded finance. NBFCs partner with these platforms to reach customers where they already are. The model grows fast and requires careful NBFC Compliance to keep things fair.

Data-Based Lending

UPI, GST, and digital payments have created rich data trails.

India now records 14 billion+ UPI transactions every month.

Source: https://www.npci.org.in/what-we-do/upi/upi-product-statistics

NBFCs use this data to understand who can repay, which makes lending safer and helps with NBFC Compliance reports.

Co-Lending

Banks have money. NBFCs have reach. Co-lending brings them together. This model is growing at 25%+ year-on-year and is supported by new NBFC Compliance frameworks that ensure transparency.

Growth in Small Towns

Loan demand in smaller cities and rural India is rising fast. NBFCs already have deep roots here. With clean NBFC Compliance practices and proper NBFC Registration, scaling becomes much easier.

The Digital Lending Wave

Digital lending is rewriting how credit works.

Instant Results

A loan that once took days now gets approved in minutes. Over 85 percent of NBFC loan applications start online today.

Digital records make NBFC Compliance tasks far simpler.

Fintech Partnerships

Fintechs offer tech. NBFCs bring licenses, NBFC Registration status, and NBFC Compliance systems. Together, they create smarter lending models.

Smarter Credit Checks

New types of data, like UPI use, online buys, or SMS money flows, help NBFCs give loans even to people who don’t have old credit scores. This also improves NBFC Compliance monitoring.

Automation

Automation lowers errors and speeds up audits. It directly strengthens NBFC Compliance and simplifies NBFC Registration renewals.

Risks

Some digital lenders misuse customer data or use forceful recovery tactics. RBI’s new rules fix many of these issues and push NBFCs to maintain solid NBFC Compliance.

The Rulebook That Shapes NBFCs

Scale-Based Regulation

RBI now divides NBFCs into four layers based on size and risk. Bigger NBFCs face more detailed NBFC Compliance rules.

Source: https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12176&Mode=0

Which layer an NBFC falls under depends on its NBFC Registration category.

New Digital Lending Rules

These rules ensure:

- fair pricing

- no hidden charges

- clean data practices

- transparent loan terms

Every NBFC Registration holder offering digital loans must follow these NBFC Compliance standards.

Governance Rules

NBFCs must have better audits, board oversight, and risk checks. All these fall under expanded NBFC Compliance.

Impact on Business

Following rules costs money, especially for small NBFCs. Many now seek NBFC Registration only after setting up strong tech and NBFC Compliance systems.

Tech That Will Drive the Next Phase

AI and Machine Learning

AI scans bank statements, predicts defaults, and spots fraud. It makes NBFC Compliance checks faster and more reliable.

Cloud and API Networks

API systems connect NBFCs to Aadhaar, GST, UPI, banks, and bureaus. They help both NBFC Registration workflows and NBFC Compliance filings.

Cybersecurity

NBFCs deal with sensitive data. Strong cybersecurity is now a core part of NBFC Compliance, and even NBFC Registration requires proof of secure systems.

Where the Big Opportunities Are

MSME Lending

India has 63 million MSMEs. Many still struggle for credit.

Source: https://msme.gov.in/know-about-msme

NBFCs with strong NBFC Compliance and NBFC Registration can lead this space.

Consumer Credit + BNPL

Online shopping is booming. Short-term credit grows with it. Safe BNPL needs clean NBFC Compliance, and more firms are applying for NBFC Registration in this segment.

Rural and Small-Town India

Smartphones and digital payments are bringing new borrowers online. NBFCs with the right NBFC Registration and NBFC Compliance setup can grow fast here.

Green Finance

India’s push for EVs and solar power opens new lending opportunities. Green NBFCs must show strong NBFC Compliance to attract investors. NBFC Registration in this niche is rising too.

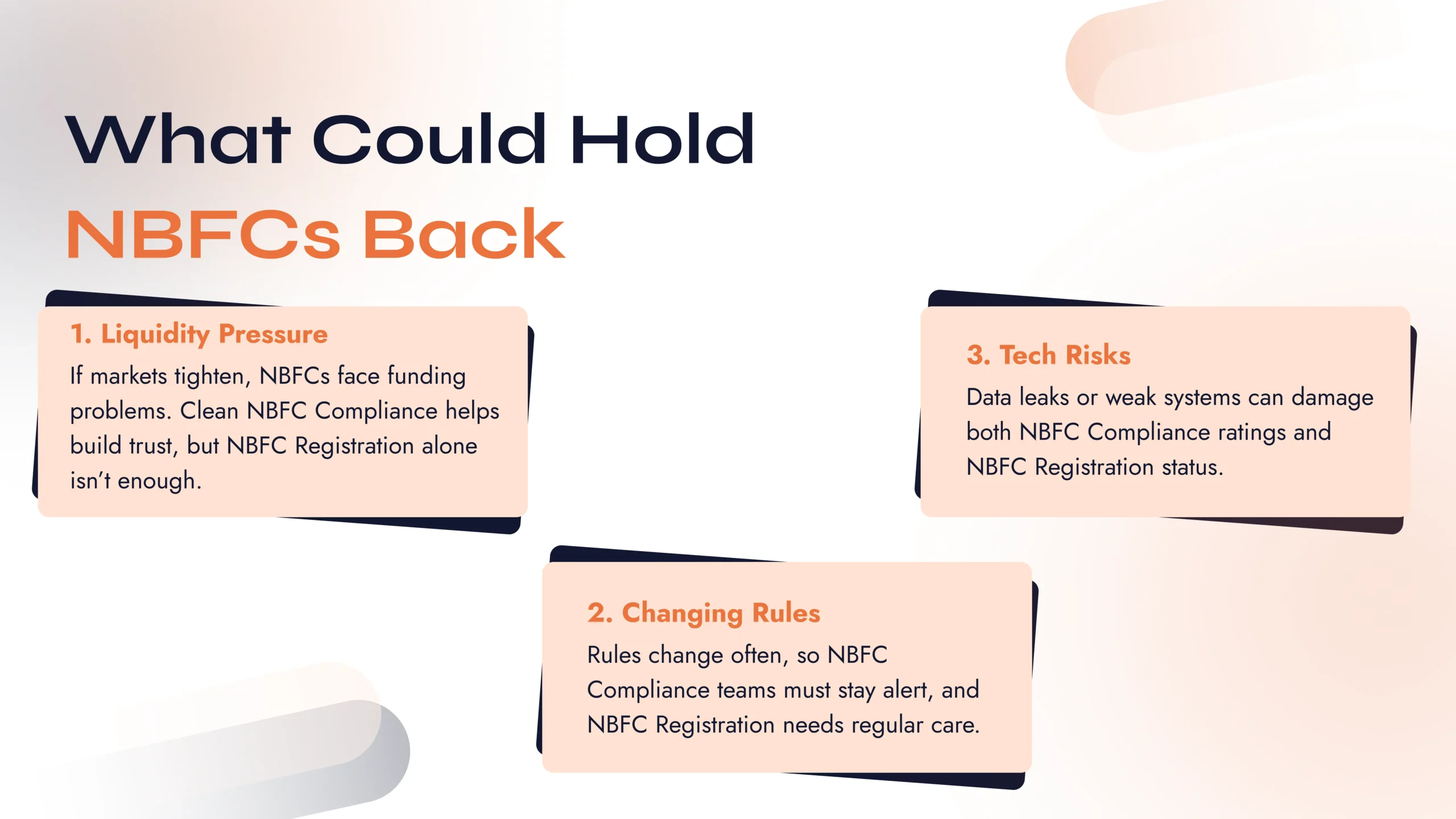

What Could Hold NBFCs Back

Liquidity Pressure

If markets tighten, NBFCs face funding problems. Clean NBFC Compliance helps build trust, but NBFC Registration alone isn’t enough.

Changing Rules

Rules change often, so NBFC Compliance teams must stay alert, and NBFC Registration needs regular care.

Tech Risks

Data leaks or weak systems can damage both NBFC Compliance ratings and NBFC Registration status.

How NBFCs Can Build a Strong Future

Go Digital

Digital tools simplify both lending and NBFC Compliance. They also strengthen NBFC Registration readiness.

Strengthen Risk Systems

NBFC Compliance depends on risk checks, fraud control, and good audits. Strong systems help NBFCs grow safely.

Improve Customer Experience

Clear terms, simple processes, and quick help matter. Better service also supports NBFC Compliance requirements.

Choose Scalable Models

Digital loans, co-lending, and on-the-spot loans grow fast when NBFC Registration and NBFC Compliance are done right.

Final Thoughts

NBFCs have shaped India’s lending journey for years, and their role will only grow from here. Tech is pushing them forward. Rules are guiding them toward safer practices. Customers expect speed, clarity, and trust.

At the heart of all this are two things: NBFC Registration and NBFC Compliance.

Any NBFC that treats these as long-term pillars—not just formalities will grow strong in the coming decade.

India needs more credit. It needs safe and fair credit. With the right systems in place, NBFCs can help millions move toward a better financial future.

Need Expert Help?

If you want to start an NBFC, fix your NBFC Compliance setup, or make your NBFC more digital, getting expert help makes everything easier. NBFC Registration, reporting, audits, and RBI filings take time and accuracy. A specialist can guide you through every step, help you avoid mistakes, and set up systems that keep you safe as rules keep changing.

Whether you’re launching a new NBFC or scaling an old one, the right advice can save you stress, money, and months of trial and error.

Contact our consultants today.

📞 Call NBFC Advisory: +91 93287 18979

🌐 Visit: www.nbfcadvisory.com