Non-Banking Financial Companies, or NBFCs, play an important role in India’s lending system. They help people who cannot easily get loans from banks or who need money quickly. NBFCs give loans for homes, vehicles, small shops, and daily needs. They also support digital loan apps and help people take their first loan.

What makes NBFCs different is that they cannot take regular deposits like savings accounts. Because of this, they follow a lighter structure and can move quickly. Even then, they must follow rules set by the Reserve Bank of India (RBI). These rules guide how NBFCs lend, manage money, and reduce risk.

In 2025, the NBFC sector is growing fast. New RBI updates, better fraud controls, and AI-based tools are changing how these companies work. Demand for credit in housing, small business, and microfinance remains strong, and NBFCs continue to fill the gap where banks often slow down.

They grow by knowing their customers, taking smart risks, and using technology. With strong RBI rules and better digital tools, NBFCs will keep shaping how credit works in India.Official RBI definition and guidelines

collect payments

Good NBFCs spread their loans across many customer types and use strong digital tools to collect payments.

Good NBFCs spread their loans across many customer types and use strong digital tools to collect payments.

Good NBFCs spread their loans across many customer types and use strong digital tools to collect payments.

This Blog explains the main NBFC business models, how they work, and why they matter for India’s financial growth. It also shares RBI data and easy examples to help you understand everything clearly.

What Are NBFCs and Why Do They Matter?

An NBFC gives loans, credit, leasing, and investment services. But it is not a bank. It cannot let you keep money in a savings or current account. Still, NBFCs can lend, invest, and support many financial needs. The RBI regulates them under the RBI Act, 1934.

Official RBI definition and guidelines:

https://www.rbi.org.in/commonman/english/scripts/FAQs.aspx?Id=1167

Know More: What is an NBFC?

Why are NBFCs so important?

They serve people banks often overlook, like small shop owners, gig workers, rural families, and first-time borrowers. They also support those with fewer documents.

Since their process is quick and straightforward, people can get money when they need it most.

RBI data shows that non-food bank credit grew around 9.9% year-on-year in mid-2025, but several areas where NBFCs dominate grew even faster, such as housing and vehicle loans.

Source (media report based on RBI data): https://indianexpress.com/article/business/banks-non-food-credit-growth-slows-rbi-data-10219991

NBFCs act like speedboats. They move fast, take smart risks, and reach places banks take too long to serve.

The Most Common NBFC Business Models

NBFCs use different models to make money and serve different customers.

Here are the main ones.

Asset Finance Companies (AFCs)

AFCs finance assets you can touch cars, tractors, trucks, machines, and construction tools. These loans use the asset itself as security.

How their model works:

- You pay a small part upfront.

- The NBFC pays the rest.

- The asset stays with you but is tied to the NBFC.

- If you don’t pay, the NBFC can take the asset back.

AFCs are strong in rural and semi-urban areas. They understand farmers, truck drivers, and small contractors better than banks. Because incomes here can be seasonal, AFCs rely on field teams who know local conditions.

Loan Companies (Including Consumer Finance NBFCs)

These NBFCs offer many types of loans:

- Personal loans

- Business loans

- Education loans

- Medical loans

- Phone and gadget loans

- App-based small loans

Many of these loans are unsecured, meaning no collateral.

Their model is simple:

- Borrow money from banks or investors at a lower rate.

- Lend it to customers at a higher rate.

- Earn the difference.

In 2025, this model is booming. Loans get approved in minutes because NBFCs use eKYC, digital checks, and AI to understand a customer’s ability to repay. These tools help them catch fraud and reduce risk.

Microfinance Institutions (MFIs)

MFIs give very small loans to people who have never taken a loan before. These loans often go to women running tiny businesses like stitching, farming, or home shops.

MFIs use group lending. A group of women promises to help each other repay. This creates:

- Very high repayment rates

- Trust in the community

- Lower collection costs

- Simple onboarding

MFIs use mobile tools, biometric KYC, and digital collections to reach thousands of villages. They are key to India’s financial inclusion goals.

RBI rules for microfinance were updated in 2022 to make lending fair and flexible:

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12187

Housing Finance Companies (HFCs)

HFCs only give home loans. These loans last many years and are secured by the house.

They finance:

- Affordable homes

- Middle-class homes

- Home repairs

- Self-employed borrowers

Housing loans stay strong even when other credit slows. In mid-2025, RBI data shows housing loans continued to grow, even though overall credit growth dropped.

RBI credit data links (consolidated reports):

https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=54663

HFCs are good at judging self-employed customers, who may not have steady monthly income.

Infrastructure Finance Companies (IFCs)

IFCs handle the biggest loans in the country. They finance:

- Roads

- Rail and metro

- Power plants

- Ports

- Airports

These loans last 10–20 years and are tied to government plans or big companies.

The model is slow but steady. IFCs must check every part of a project land, clearances, cash flow, timelines. Delays can block money for years, so this model needs strong planning.

RBI classification guidelines for IFCs:

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=5367

Investment Companies

These NBFCs invest money on behalf of clients. They work with:

- Equity

- Debt

- Mutual funds

- Corporate bonds

- Other investment products

They earn from fees, advisory work, and returns on investments. Their job is less about lending and more about choosing the right assets.

Fintech-Based NBFC Models

Fintech NBFCs are the fastest-growing category. They rely completely on technology.

What makes them huge today:

- Instant loan approvals

- AI-based scoring

- Fraud detection tools

- Loans inside shopping apps

- API links to banks

- BNPL (Buy Now Pay Later)

Many fintech NBFCs also use co-lending. In this model, banks and NBFCs share the loan and share the risk. This helps NBFCs scale without needing massive funds.

RBI’s digital lending guidelines from 2022 and 2023 guide this sector:

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12340

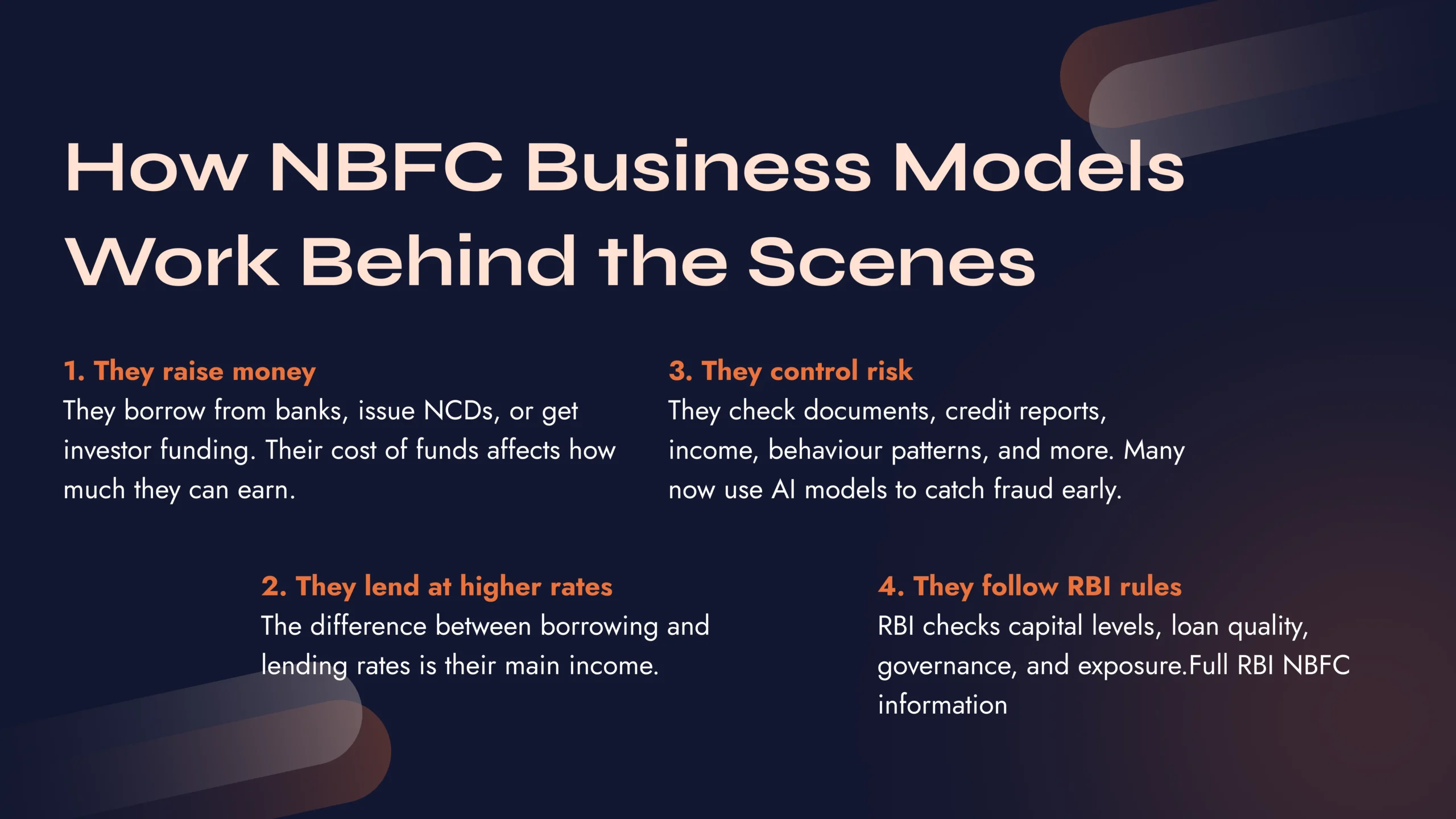

How NBFC Business Models Work Behind the Scenes

Every NBFC follows the same basic steps:

They raise money

They borrow from banks, issue NCDs, or get investor funding. Their cost of funds affects how much they can earn.

They lend at higher rates

The difference between borrowing and lending rates is their main income.

They control risk

They check documents, credit reports, income, behaviour patterns, and more. Many now use AI models to catch fraud early.

They follow RBI rules

RBI checks capital levels, loan quality, governance, and exposure.

Full RBI NBFC information: https://www.rbi.org.in/commonman/English/scripts/NBFCs.aspx

Know more: RBI’s Co-Lending Model Guidelines for Banks and NBFCs

Challenges and Risks NBFCs Face

Even strong NBFCs face risks:

Liquidity risk

They borrow short-term but lend long-term. If funding dries up, they face trouble.

Regulatory pressure

RBI keeps improving rules. NBFCs must adapt fast.

Default risk

In hard times, people may not repay on time.

Competition

Banks and fintech players offer faster, smarter products.

Cost of funds

If interest rates rise, NBFC profits fall.

Good NBFCs spread their loans across many customer types and use strong digital tools to collect payments.

Examples of Leading NBFCs

Every major NBFC wins in its own area:

- Bajaj Finance — leader in consumer loans

- Shriram Finance — strong in vehicle loans

- LIC Housing Finance — major home loan provider

- CreditAccess Grameen — trusted in microfinance

- Fintech NBFCs — fast-growing with AI-powered lending

They succeed because they know their customers well and use technology smartly.

The Future of NBFCs

NBFCs will keep growing as tech becomes stronger. Soon, you’ll see:

- AI-based loan approval everywhere

- Real-time fraud checks

- Co-lending becoming normal

- More green and climate loans

- Digital credit in rural India

- Blockchain for document checks

Even though some credit areas slowed in 2025, NBFC demand for home loans, gold loans, and small business loans remains strong.

Wrapping It Up

NBFCs play a big role in India’s financial system. Their business models asset finance, consumer loans, microfinance, housing, infrastructure, investments, and fintech lending each solve different needs.

They grow by knowing their customers, taking smart risks, and using technology. With strong RBI rules and better digital tools, NBFCs will keep shaping how credit works in India.

If you want to understand which NBFC model fits your plan or you’re thinking of starting an NBFC, the NBFC Advisory team can guide you, answer your questions, and help you build the right path.

Connect with an Expert for any inquiry.

📞 Call NBFC Advisory: +91 93287 18979

🌐 Visit: nbfcadvisory.com