India’s financial system is undergoing rapid change, and Non-Banking Financial Companies (NBFCs) are emerging as key players in this transformation. They help people and businesses access credit, especially in areas where traditional banks don’t reach. From supporting small businesses to driving fintech innovation, NBFCs play a significant role in enhancing financial inclusion in India.

If you want to start a financial company, the first step is to get an NBFC license from the Reserve Bank of India (RBI).

At NBFC Advisory, we guide clients through every step of the NBFC registration process. In this blog, you’ll find everything you need to know—from who can apply and what documents are required, to the licensing steps and compliance after approval.

What is an NBFC?

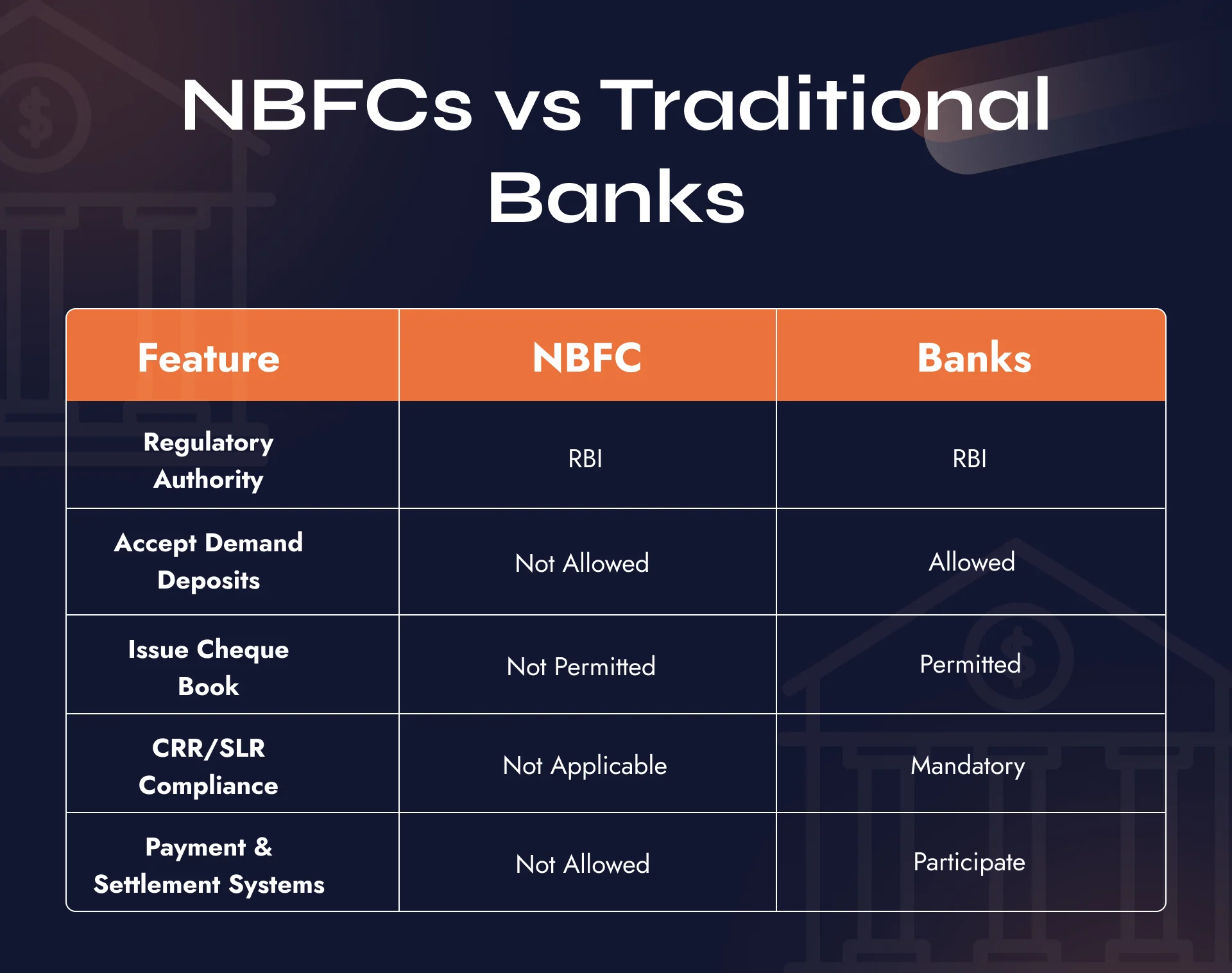

A Non-Banking Financial Company (NBFC) is a company that provides financial services, including lending, offering credit, and facilitating investments and asset purchases. However, unlike regular banks, NBFCs don’t accept savings deposits, don’t issue cheque books, and don’t operate payment systems. They are registered under the Companies Act and regulated by the Reserve Bank of India (RBI). NBFCs are regulated by the RBI under the Reserve Bank of India Act, 1934.

NBFCs are regulated by the RBI under the Reserve Bank of India Act, 1934. They play a crucial role in extending financial services to areas that traditional banks do not adequately serve.

Read More: What is an NBFC?

NBFCs vs Traditional Banks

NBFCs offer a nimble and innovative approach to finance and credit delivery, especially in niche sectors and rural markets.

Types of NBFCs Regulated by RBI

NBFCs are classified by the RBI based on the nature of their operations. Here are the major categories:

1. NBFC-Investment and Credit Company (NBFC-ICC)

This is the most common type for general lending, investment, and asset finance. It combines features of loan companies, investment companies, and asset finance firms.

2. NBFC-Micro Finance Institution (NBFC-MFI)

These NBFCs primarily offer small loans without collateral to individuals with low incomes and small business owners. Their goal is to bring financial services to areas where banks are usually not available.

3. NBFC-Asset Finance Company (NBFC-AFC)

Focused on financing physical assets like vehicles, equipment, and machinery. A significant portion of the deployed capital must be allocated to tangible assets.

4. NBFC-Infrastructure Finance Company (NBFC-IFC)

Specialises in financing infrastructure projects such as roads, power plants, and telecom infrastructure. Requires larger capital and stricter exposure norms.

5. Core Investment Company (CIC)

A non-deposit taking NBFC that primarily holds shares and securities of group companies. At least 90% of total assets must be in the form of investments in equity shares, preference shares, debt, or loans to group companies, with not less than 60% in equity instruments.

6. NBFC-Factor

Engaged in factoring receivables—essentially buying a business’s unpaid invoices to help with cash flow.

7. NBFC-Peer to Peer Lending Platform (NBFC-P2P)

Operates digital platforms that match borrowers with lenders directly without any credit involvement of the NBFC itself.

8. NBFC-Account Aggregator (NBFC-AA)

Facilitates the secure, consent-based sharing of financial data between institutions for improved access to financial services.

9. Mortgage Guarantee Companies (MGCs)

Provide guarantees on housing loan defaults to housing finance institutions or banks.

Who Can Apply for an NBFC License?

To be eligible for an NBFC license, the applicant must:

- Be a company registered under the Companies Act, 2013

- Have a minimum Net Owned Fund (NOF) of ₹10 crore

- Pass the RBI’s Fit and Proper criteria for all directors and promoters

Fit and Proper Criteria:

Promoters and directors must:

- Have a clean financial and legal record

- Possess relevant financial or business experience

- Maintain sound creditworthiness and reputation.

This ensures only qualified individuals operate financial institutions under RBI supervision.

Documents Required for NBFC License

A successful NBFC application starts with thorough documentation. The key documents include:

- Certificate of Incorporation and MOA/AOA

- PAN, Aadhaar, and Address Proofs of directors/shareholders

- Detailed 5-year business plan and financial projections

- Auditor’s certificate confirming NOF

- Credit reports (from CIBIL or any RBI-registered credit bureau) and net worth statements of all directors and promoters

- Board Resolution authorising NBFC application

- Proof of NOF deposit in a scheduled bank

- Policies on KYC, AML, risk management, and customer grievance redressal

Each document must comply with the RBI’s standards to avoid delays or rejections in application processing.

Step-by-Step Process to Obtain an NBFC License

Here’s the streamlined process we follow at NBFCAdvisory.com to help clients register their NBFCs:

Incorporate a Company

Start by registering a Private or Public Limited Company through the Ministry of Corporate Affairs.

Meet NOF Requirement

The required NOF amount (₹10 crore) must be maintained in the form of free reserves in a scheduled commercial bank, as certified by a statutory auditor. This amount must not be used until the NBFC license is granted.

Prepare Application

Compile all required documents including business plan, director profiles, compliance manuals, and other annexures.

Online Application via PRAVAAH Portal

Submit the NBFC license application through the PRAVAAH (Platform for Regulatory Application, Validation and Authorization) Portal of the RBI. Upon submission, you will receive an acknowledgment and application reference number.

Know More: RBI Makes PRAVAAH Portal Mandatory for All Regulatory Applications from May 1, 2025

RBI Scrutiny and Due Diligence

RBI will evaluate:

- Promoter background and experience

- Capital structure

- Financial soundness

- Operational readiness

Certificate of Registration (CoR)

If all conditions are met, the RBI will grant a Certificate of Registration (NBFC certificate), officially authorising you to commence NBFC operations.

Post-License Compliance Requirements

Receiving your NBFC license is only the beginning. Ongoing regulatory compliance is mandatory.

RBI Returns & Filings

Key Post-License Compliance Requirements for NBFCs

- Audited Balance Sheet & Profit & Loss Account

- Annual and Quarterly Returns

- Board Resolutions – For Non-Acceptance of Public Deposits

- CIC Reporting – i.e., CIBIL, Equifax, CRIF Highmark, Experian

- CKYC, NESL, and CERSAI Reporting

- Statutory Auditor Certificate (SAC)

KYC and AML Compliance

Strong internal frameworks are needed for:

- Customer onboarding

- Identity verification

- Fraud detection and reporting

Statutory Audits

Conduct and file statutory audits in accordance with the Companies Act, 2013 and RBI’s NBFC Master Directions. Submit the audited financials and auditor’s report to RBI annually.

Risk & Governance Systems

You must implement:

- Risk assessment policies

- Internal controls and audit procedures

- Grievance redressal mechanisms

- Independent board oversight

Know More: Post-Incorporation Compliances for NBFC

Time Required to Obtain NBFC License

The licensing process typically takes 4 to 6 months. However, this can vary based on RBI scrutiny, document completeness, and promoter verification.

| Stage | Estimated Duration |

| Company Incorporation | 10–15 days |

| Capital Setup & Documentation | 2–3 weeks |

| Application Preparation | 1 week |

| RBI Processing & Approval | 3–6 months |

We recommend planning and engaging professionals to avoid unnecessary delays.

Final Thoughts

Getting an NBFC license from the RBI is a significant step that requires strong financial backing, full compliance with regulations, and a clear business vision. It is a critical regulatory approval that mandates full compliance with RBI norms and safeguards public financial interest.

At NBFC Advisory, our experienced team has successfully assisted businesses across India in navigating every step of the NBFC registration process—from incorporation to post-licensing compliance. Our team stays updated with the RBI’s changing rules and provides comprehensive support, from documentation to post-licensing compliance. Whether you’re setting up a lending platform, asset finance company, or investment business, we help you begin smoothly and stay fully compliant at every stage.

Need Expert Guidance?

Contact our consultants today.

📞 Call NBFC Advisory: +91 93287 18979

🌐 Visit: www.nbfcadvisory.com