Starting a finance company is a big move. Many people want to give loans, help small businesses, or support customers who can’t get money from banks. But before any company can begin this work in India, it must go through NBFC registration.

This process may sound heavy. But once you understand the steps, it becomes clear. Think of NBFC registration as the doorway you must walk through to enter the financial world the right way.

In this simple guide, you’ll learn what the RBI checks, what papers you must have, what errors to avoid, and how to make your NBFC registration easy and strong.

Let’s break it down.

What an NBFC Really Is

An NBFC is a Non-Banking Financial Company. It is not a bank. It cannot take savings like a bank. But it can still help people and businesses in many ways. It can offer loans, credit, investment help, and simple finance plans.

To do any of this legally, the company needs NBFC registration. Without that registration, no finance activity is allowed. So the first step is to understand the rules and prepare for NBFC registration.

KNow More: What is an NBFC?

Why NBFC Registration Matters

Money is sensitive. People trust companies with their plans, dreams, and problems. This is why the RBI checks everything before giving NBFC registration.

A registered NBFC signals trust. It tells people the company is approved, follows rules, and is safe to deal with.

This protects customers. It protects the finance system. And it also protects you as a founder, because you start on a clean and legal path.

The Main Prerequisites for NBFC Registration

Now let’s talk about what you need before applying for NBFC registration. These are the basic steps every company must complete.

Form a Company

Start a company under the Companies Act. This structure allows you to file for NBFC registration.

You need:

- Certificate of Incorporation

- Memorandum of Association

- Articles of Association

- A board resolution stating you want to apply

Without these, NBFC registration cannot begin.

Have the Required Capital

Capital is the backbone of a finance company. The RBI checks if you have enough money before moving ahead with NBFC registration.

Capital rules are stricter now. To demonstrate adequate capital, you may need auditor reports and a net worth certificate issued by a practising professional.

Weak capital slows or stops NBFC registration.

Have a Fit and Proper Team

The RBI reviews the people behind the company with care. Every promoter, director, and key manager must clear the “fit and proper” test.

This includes:

- Clean financial history

- No criminal cases

- Clear background

- Good reputation

- Honest source of funds

If anything looks unclear, the NBFC registration process gets delayed.

Create a Clear and Simple Business Plan

Your plan tells the RBI how you will run the business once you receive NBFC registration.

It should explain:

- What services you will offer

- Who your customers are

- How you will handle risk

- How you will recover loans

- How you plan to grow

- Basic financial projections

A simple, honest plan makes NBFC registration easier.

Set Up a Basic Office and Working System

RBI wants proof that your company is real and ready, not just a paper entity.

Before NBFC registration, have:

- A real office space

- Simple tech systems

- Basic staff

- Clear workflow

- Internal controls

A weak setup delays NBFC registration.

Keep Clean Financial Records

Even new companies must have simple, clear financial documents.

These include:

- Audited financials

- Proof of capital

- Shareholder details

These help the RBI verify everything before giving NBFC registration.

The NBFC Registration Process Explained Simply

Once you have all the basics ready, you can start the NBFC registration process.

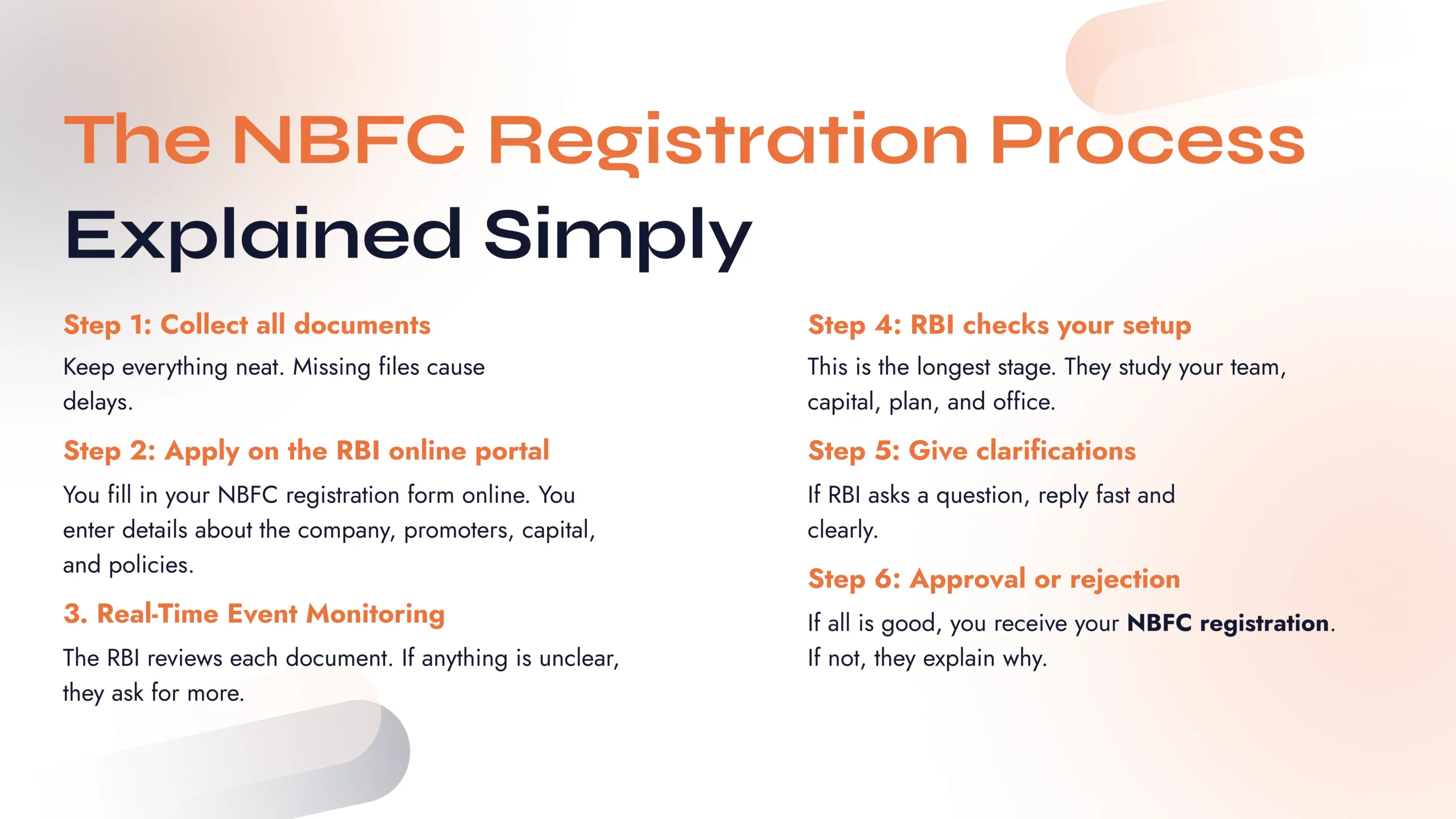

Step 1: Collect all documents

Keep everything neat. Missing files cause delays.

Step 2: Apply on the RBI online portal

You fill in your NBFC registration form online. You enter details about the company, promoters, capital, and policies.

Step 3: Upload all documents

The RBI reviews each document. If anything is unclear, they ask for more.

Step 4: RBI checks your setup

This is the longest stage. They study your team, capital, plan, and office.

Step 5: Give clarifications

If RBI asks a question, reply fast and clearly.

Step 6: Approval or rejection

If all is good, you receive your NBFC registration. If not, they explain why.

Recent Changes That Affect NBFC Registration

RBI rules have become stricter over the years. Many companies that could register earlier cannot register today.

Changes include:

- Higher capital requirement

- Stricter checks now apply to directors and shareholders.

- More review of business plans

- More focus on risk control

- Stronger compliance rules

- Closer monitoring of NBFC operations

Because of these changes, fewer companies qualify. That means NBFC registration now needs better planning and stronger documents.

Why Many NBFC Registration Applications Fail

Most failed applications fall into the same pattern.

Weak capital

Showing capital on paper without real proof stops NBFC registration.

Poor business plan

Copy-paste plans or unrealistic ideas raise concerns with the RBI.

Unfit directors

Any hidden issue creates red flags.

Incomplete documents

Missing or unclear documents slow down or stop the process.

Avoiding these mistakes makes NBFC registration smoother.

Tips to Make NBFC Registration Easier

Here are simple, practical tips:

- Keep your documents clean and complete

- Write a simple, honest plan

- Pick directors with clean records

- Prove your capital clearly

- Set up a real office

- Draft policies early

- Reply quickly to RBI

These steps help your NBFC registration move forward without stress.

A Detailed Checklist for NBFC Registration

Before filing, check if you have:

- Company incorporation papers

- Minimum capital in place

- Director IDs and background info

- Fit and proper declarations

- Clear business plan

- Office proof

- Tech setup

- All required policies

- Auditor certificates

- Bank confirmations

- Board resolution

- Online application

If all this is ready, you can file your NBFC registration with confidence.

Life After NBFC Registration

After approval, you must follow RBI rules every year:

- Submit reports on time

- Follow fair practices

- Keep accounts clean

- Update policies

- Handle customer complaints

- Follow KYC and AML rules

- Stay transparent with RBI

Good compliance keeps your NBFC registration active and safe.

Final Thoughts

Starting an NBFC is a long-term commitment. But with the right plan and clean preparation, NBFC registration becomes a smooth and manageable process.

You prepare your company. You build your team. You set up your office. You write your policies. You file your documents. And step by step, you meet each requirement.

At the end, NBFC registration gives you a legal, trusted path to run a real finance business that supports people and businesses across India.

Need Help With NBFC Registration?

If you want clear help, easy paperwork, or full support, a good NBFC advisory team can make the whole process much simpler.

They can help you:

- Prepare documents

- Draft policies

- Build a business plan

- Review your capital structure

- File your application the right way

- Reply to RBI queries

- Avoid common mistakes

If you want, I can help you create a perfect NBFC registration package or connect you with a full NBFC Setup to NBFC advisory setup. Just tell me what you need.

📞 Call NBFC Advisory: +91 93287 18979

🌐 Visit: nbfcadvisory.com