India’s financial structure is built on two strong pillars — banks and Non-Banking Financial Companies (NBFCs). While banks mainly cater to big businesses and the organized sector, NBFCs reach the segments that banks often overlook small entrepreneurs, local traders, and individuals who still depend on alternative credit sources. In many ways, they’re the bridge between traditional finance and the real economy.

However, not every company offering loans operates within the law. Many unregistered players falsely claim to be “RBI-approved,” putting borrowers at serious risk. To separate the genuine from the fake, the NBFC registration system exists.

NBFC registration is the mandatory process that authorizes a company to operate as a lender under the supervision of the Reserve Bank of India (RBI). Once a company completes this process, its name is included in the RBI registered NBFC list the official public record of recognized financial institutions.

For borrowers, this list ensures safety and accountability. For business owners, it’s a license that brings credibility, compliance, and access to funding.

This guide explains how NBFC registration works, who qualifies, and how to verify whether a company truly appears on the RBI registered NBFC list in simple, practical language.

What is an RBI Registered Loan Company?

An NBFC or Non-Banking Financial Company, is a type of financial institution that offers loans, credit, and investment services without having a traditional banking license. These companies have become a key part of India’s financial network, helping individuals and businesses get easier access to funds when banks can’t or won’t lend to them.

When a company completes the NBFC registration process, the RBI grants it a Certificate of Registration (CoR), confirming that it meets all legal and regulatory requirements. Only then can it lend, invest, or engage in financial activities under RBI supervision.

The RBI registered NBFC list includes all such approved companies. It’s a public document confirming which lenders are genuine, compliant, and authorized to operate.

Who Can Register as an NBFC with the RBI?

Not every business is eligible for NBFC registration. The Reserve Bank of India has laid down strict criteria to make sure that only financially stable and well-governed companies are allowed to operate within the lending sector.

To apply for NBFC registration, a company must:

- The company must be registered under the Companies Act, 2013.

- It should have a minimum Net Owned Fund (NOF) of ₹10 crore.

- The promoters and directors must meet the RBI’s fit and proper eligibility standards.

- A clear and focused business plan centered on financial and lending activities is required.

- The organization must ensure complete transparency in its ownership, capital structure, and governance practices.

RBI reviews each application in detail before approving NBFC registration evaluating financial stability, ownership structure, and managerial competence.

Why RBI Registration Matters

The NBFC registration certificate is far more than a simple document it’s what gives a lending company its legal standing and credibility in the financial system.

Here’s why it carries so much weight:

- Legal protection: Borrowers are safeguarded from illegal moneylenders and exploitative loan practices through RBI oversight.

- Trust and credibility: Registration with the RBI builds confidence among investors, banks, and customers, making partnerships easier and more reliable.

- Access to funding: Having an official NBFC license enables companies to obtain capital from banks, financial institutions, and investors to expand their lending operations.

- Regulatory supervision: The RBI continuously monitors registered NBFCs to ensure stability and compliance across the sector.

Running a lending business without a valid NBFC registration violates the RBI Act, 1934, and can result in severe penalties, cancellation of operations, or even criminal prosecution.

Where to Find the Official RBI Registered Loan Company List

To confirm whether a lender is genuine, you must check the RBI registered NBFC list the only official record maintained by the Reserve Bank of India.

Here’s how to access it:

- Visit rbi.org.in.

- Go to the section titled Financial Entities → List of NBFCs.

- Download the relevant lists, which include:

- Active registered NBFCs

- Cancelled or surrendered licenses

- Deposit-taking and Non-deposit-taking NBFCs

If a company isn’t on the list, it isn’t authorized to lend — no matter what its website or marketing claims.

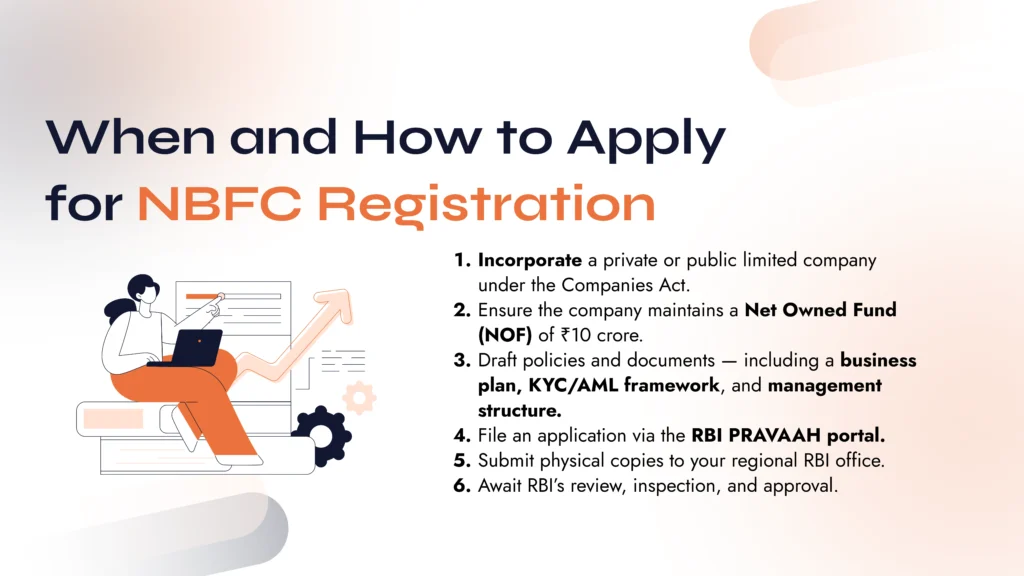

When and How to Apply for NBFC Registration

The NBFC registration process takes careful preparation and several months to complete.

Here’s the simplified process:

Once approved, the company receives its NBFC license — the Certificate of Registration (CoR). It’s then added to the RBI registered NBFC list, confirming its legitimacy.

How to Check the Validity of an NBFC’s License

Verifying a company’s NBFC registration status is simple and vital before borrowing or partnering.

Follow these steps:

- Go to the RBI’s official NBFC list page.

- Search by company name or registration number.

- Check its status — it should show as “Active.”

- Cross-check company details on mca.gov.in using its CIN.

If the company doesn’t appear or shows “Cancelled,” avoid dealing with it. Fake lenders often use names similar to real NBFCs to mislead borrowers.

Key RBI Guidelines NBFCs Must Follow

Every organization that completes the NBFC registration process must strictly adhere to the financial and operational guidelines set by the Reserve Bank of India (RBI). The key requirements include:

- Fair Practices Code (FPC): NBFCs must provide borrowers with clear information about loan terms, interest rates, and any applicable charges to maintain full transparency.

- KYC and AML Compliance: Proper verification of each customer’s identity is mandatory to prevent fraud, money laundering, and misuse of financial services.

- Capital Adequacy Ratio (CRAR): Companies must maintain adequate capital reserves that correspond to the level of risk in their lending activities.

- Asset Classification: NBFCs are required to accurately identify and report non-performing assets (NPAs) to ensure their financial statements remain correct and reliable.

- Ethical Recovery: All recovery actions must be carried out respectfully and within the law — any form of harassment, coercion, or intimidation is strictly prohibited.

The Future of NBFCs in India

NBFCs have transformed credit delivery in India from microloans and vehicle finance to SME funding and fintech-based lending.

The future of lending is moving toward digital NBFC registration and technology-led credit assessment. The Reserve Bank of India is placing greater emphasis on responsible lending practices, protecting borrower information, and ensuring stronger compliance systems. In this new environment, only those NBFCs that uphold transparency, sound governance, and ethical operations will continue to grow and remain relevant.

Why Borrowers Should Always Verify RBI Registration

Before taking a loan, confirm your lender’s authenticity by checking its NBFC registration status on the RBI registered NBFC list.

Many unregistered loan apps and websites use deceptive names or fake approval numbers. Borrowers who skip verification risk losing money or personal data.

It takes less than five minutes to check — and it could save you from months of trouble.

The Future of NBFC Compliance and Regulation

The Reserve Bank of India (RBI) is steadily tightening the NBFC registration process to promote greater transparency and stability across the sector.

Recent regulatory updates emphasize:

- Data security and privacy measures for digital lending platforms.

- Clear and mandatory disclosures to borrowers regarding loan terms and charges.

- Stricter supervision of Loan Service Providers (LSPs) to ensure accountability.

In this evolving regulatory environment, only those NBFCs that uphold strong governance standards and stay fully compliant with RBI norms will continue to hold their place on the RBI registered NBFC list.

Conclusion

The RBI registered NBFC list is more than a directory it’s a safeguard for borrowers and a mark of integrity for lenders.

For borrowers, it ensures they’re dealing with legitimate financial institutions. For businesses, completing NBFC registration builds long-term credibility and opens access to funding.

If you’re entering the lending space, treat compliance as your foundation.

If you’re borrowing, trust only what’s verified. In finance, credibility isn’t advertised it’s earned through registration, regulation, and responsibility.

If you plan to launch your own lending business or want professional help with the NBFC registration process, expert guidance can save you months of effort.

At NBFC Advisory, we’ve helped startups, fintech firms, and established lenders achieve full RBI compliance from NBFC registration and licensing to audits, legal documentation, and ongoing RBI reporting.

Our team of finance and legal experts brings over a decade of real-world experience in NBFCs, fintech, and regulatory strategy.

We provide expert support in the following areas:

- Forming a new NBFC or restructuring your existing company in line with RBI requirements.

- Creating and reviewing RBI-compliant documentation and internal policies that fit your business model.

- Managing all RBI interactions, including correspondence, inspections, renewals, and regulatory submissions.

- Auditing and aligning business operations to ensure complete legal and compliance accuracy.

Book a free consultation with our NBFC specialists today. Let’s make your company compliant, credible, and ready to scale the right way.

📩 Email: Sales@violet-lemur-440949.hostingersite.com

🌐 Website: nbfcadvisory.com

📞 Call NBFC Advisory: +91 93287 18979

FAQs

What is NBFC registration?

It’s the RBI’s official approval process that allows a company to legally lend or operate financial services in India. Without this license, a company cannot act as a lender.

How long does the NBFC registration process take?

Typically, it takes between 4 to 6 months, depending on how complete and accurate your documents are.

What is the minimum capital required for NBFC registration?

Most NBFCs must maintain a Net Owned Fund (NOF) of ₹10 crore.

How can I check if an NBFC is genuine?

Visit the RBI’s official website and check the RBI registered NBFC list. Search for the company’s name or registration number.

Can a private limited company apply for NBFC registration?

Yes. A private or public limited company can apply if it meets all RBI criteria and maintains the required capital.

What happens if an unregistered company provides loans?

Lending without NBFC registration is a punishable offense under the RBI Act, 1934.

Can fintech startups apply for NBFC registration?

Yes. Many fintechs now apply for NBFC registration to offer credit legally. They must meet the same capital and compliance norms.

How does NBFC Advisory help with registration?

NBFC Advisory provides end-to-end services from preparing documents and managing RBI filings to ensuring post-registration compliance and audits.