Inside This Article

Neobanks in India— online banks, internet-only or no-branch banks.

With the catered and personalised customer solutions, in the next five years, the global NeoBank market is expected to grow at 47.1% and hit a $333.4 billion market size (CAGR).

Along with seamless 24/7 remote services, NeoBanks are easy to set up due to their low operating costs and the absence of the need for tangible land.

They are most popular among niche audiences, such as “underbanked” and “unbanked” individuals, as they offer high-interest rates and encourage them to use their services.

In this blog, we will dive into how you can set up your NeoBanks in seven steps, as well as crucial takeaways while implementing.

But first, what is the complete form of Neo Bank?

The complete name of Neo Bank is “Neo Bank,” meaning “new bank,” which is a fully digital and branchless institution. Neobanks in India are gaining fast popularity with startups and new-age businesses for their flexible, tech-driven approach.

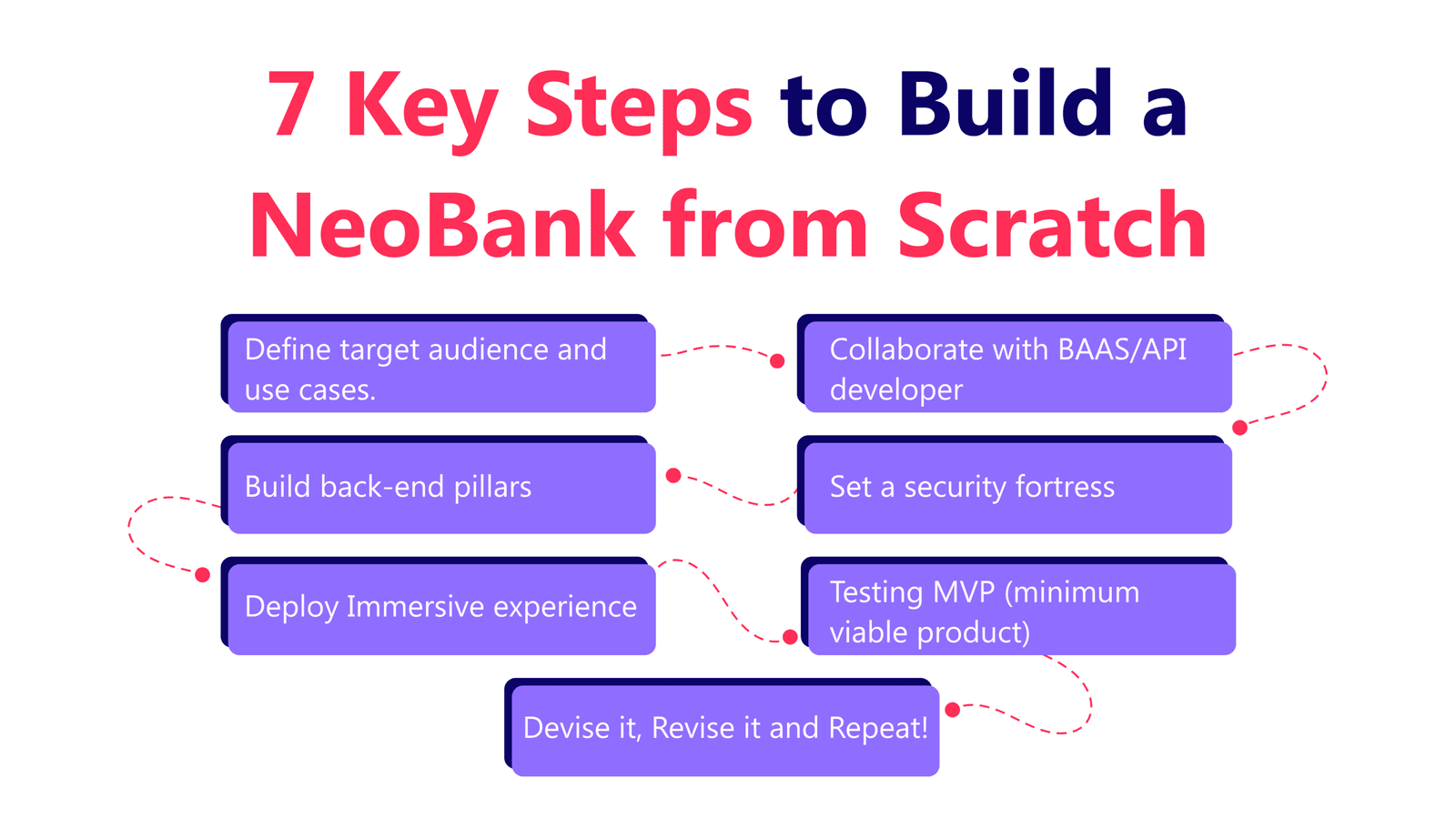

Seven steps to assist you set up your NeoBank

1. Define target audience and use cases.

Every neobanks aims to address the specific needs of its target audience. Deciding on your audience and market size is a must before taking any action.

It offers customers a hyper-personalised experience and robust knowledge about their life’s ins and outs and wants, eventually presenting your solution to their unique problems.

Craft unique use cases, define audience persona based on demographics and roles, and further locate their major pain points and desires.

This way, you can offer an imperative value proposition of features that matter to them!

Later, you can also apply this to customer segmentation and analyse your customer lifecycle.

2. Build back-end pillars

To develop a flawless Neobank for your customers, strong pillars of back-end integrations are a must.

They ensure that the system can run multiple operations and transactions without lag.

The main components of the operating system of any Neobank are:

- API – it synchronizes the workflow of your Neobank app with other processes like authentication and payment gateways.

- Card processing App – this deals with all transactions and operations involving debit or credit cards and constitutes the core logic of your applications.

- Back-office tools – these tools manage the entire workflow of your Neobank.

Creating a Neobank from scratch could be laborious as you need to invest a lot of effort, capital, and time.

However, you can cut your efforts and collaborate with an established bank NBFCs

You can leverage their reliability and fetch the early customer acquisition.

3. Deploy Immersive experience

Flawless transactions and a robust experience are vital in retaining your customers in the long run.

Constantly improving your UX, making it eye-soothing and easy to understand, shows that you’re exerting efforts to give your customers a profound reason to stay.

A well-designed app enables users to navigate your app effortlessly, completing all operations and transactions quickly while maintaining security.

Therefore, ensure that your Neobank app provides cluster-free visuals for seamless navigation and optimal customer satisfaction.

Your app must include clear CTAs, content forms, and pop-ups to help your prospect get started.

Moreover, it must be flashy, with leading speed, and, most importantly, have a manageable number of notifications.

Moreover, it must be flashy, with leading speed, and most importantly, with no overwhelming number of notifications.

You can also add customer support sections, where you can customers’ queries ASAP and help them.

4. Collaborate with BAAS/API developer

Collaborating with banks and NBFCs can boost your Neobank as it can accelerate its development process with relatively less cost and effort.

Collaborating with API providers who can help you with app development is a good idea if you want complete access to all operations.

It can make your Neobank ready to go to market ASAP, with relatively low time and cost.

However, integrating with those banks’ software is challenging and generally slow.

Backing up your Neobank to traditional banks can exponentially increase your user base, and it’s also more accessible and faster than making a back-end system from scratch.

There are also restrictions on several portfolios of customer banking products.

The advantages of collaborating with BAAS providers are almost the same as above, but they generally restrict the flexibility of your Neobank to develop new features.

5. Set a security fortress

As online security has always been connected with data breach issues with good reasons.

Having an impregnable security infrastructure is a must for your Neobanks.

Tokenisation, generation, and issuance of a payment token, as well as the maintenance of token security vaults, are challenging yet essential tasks that must be performed while maintaining PCI DSS compliance.

First, you need to set up a security office centre that governs as the controlling unit of your entire Neobank. It enables you to supervise all processes happening in the infrastructure.

You can also deploy Security Information and Event Management (SIEM) software solutions to make your infrastructure tracking more analytical and precise.

Devising a security tool of your own could be another, and perhaps a better, option. It is essential to maintain logs and records of every transaction and operation occurring in the Neobank for future reference and accountability.

Ensure that tracking your operation does not compromise customers’ privacy, and run regular tests to keep your security units up to date.

6. Testing MVP (minimum viable product)

To achieve the status of a top-notch Neobank, you need to have a lot of automated tests, which is possible through experiment-driven development.

It begins with identifying all possible use cases that customers may utilise while interacting with the app.

With manual testing, there is no chance you can identify and get rid of all issues.

So all you need to do is hire a QA engineer who can write code and run the automated tests in the system.There are a whole bunch of tests you should try for the betterment of your core system, such as:

- Integration tests

- Security tests

- Penetration tests

- User acceptance test

- Regression tests

- Unit tests

7. Devise it, Revise it and Repeat!

Finally, your NeoBank is live and ready to serve your clients!

However, the work starts here to sustain them—the customer retention.

You need to gather feedback and develop your services accordingly.

To get a clear roadmap, track crucial KPIs like CAC (customer acquisition cost) and CLV(customer lifetime value)

This further helps to segment your clients and cater remedies to their individual needs.

Another crucial aspect is marketing.

A good product will help you with retention and good marketing in acquisition.

And acquisition comes first.

This is clear with regular upgrades and proactive marketing strategies. You can churn out the best benefits for your business.

And make your customer stay with you!

Neobank vs Digital Bank: What’s the Difference?

While the terms are often used interchangeably, Neobank vs Digital Bank is an important distinction. NeoBanks are 100% online and don’t have banking licenses—they usually partner with traditional banks or NBFCs. Digital Banks, on the other hand, are usually online services run by licensed traditional banks.

Both provide digital services, but Neobanks are more flexible, technology-first, and often targeted at specific groups like small business owners, freelancers, or students.

How can we help?

To set and run your own NeoBank, you need hands-on problem-solving solutions and a catered audience to pitch to.

But there can be aspects that you might be missing. So, we are here to help you!

At NBFC Advisory, with over 15 years of experience in advisory and counselling, we help businesses better understand their audience and make their ventures thrive.

With insights and strategic deployment, our team of professionals is a one-stop solution, so you never miss an opportunity.

Need expert guidance? Get in touch with our consultants today.

Call NBFC Advisory: +91 93287 18979