Welcome to Fintech Compliance Services

Empowering Fintech Companies with Regulatory Excellence

Navigating the Fintech landscape requires more than innovation—it demands strict adherence to regulatory frameworks. At NBFC Advisory, we deliver tailored Fintech compliance solutions to help businesses in India achieve sustainable growth and regulatory excellence.

Why Fintech Compliance is Crucial

Comprehensive Guidance

We handle every step of the surrender process, ensuring you meet all regulatory requirements set by the Reserve Bank of India (RBI).

Expert Team

Our team of seasoned professionals specializes in NBFC compliance, ensuring a hassle-free and efficient surrender process.

Time & Cost Efficiency

Avoid unnecessary delays and expenses with our streamlined and transparent approach.

Customized Solutions

Every NBFC is unique. We tailor our services to meet your specific needs, offering personalized advice and solutions for NBFC surrender applications and compliance review.

Why Fintech Compliance is Crucial

Fintech compliance ensures that Fintech companies operate within the guidelines set by regulatory authorities such as the Reserve Bank of India (RBI). Non-compliance can result in severe penalties, operational disruptions, and reputational damage. A well-structured Fintech compliance checklist can help mitigate these risks and build trust among stakeholders, including customers, investors, and partners.

Our Fintech Compliance Services

Our team of experienced consultants delivers end-to-end Fintech compliance solutions to help you stay ahead of regulatory challenges. Explore our services:

Regulatory Compliance Frameworks

- Developing customized compliance frameworks in line with RBI guidelines and Fintech regulations in India.

- Ensuring adherence to the Prevention of Money Laundering Act (PMLA), KYC norms, and other regulatory requirements.

Licensing and Registration Support

- Assistance in obtaining required licenses such as Payment Aggregator (PA), Prepaid Payment Instrument (PPI), and Non-Banking Financial Company (NBFC) licenses.

- Advisory on ongoing compliance requirements post-licensing under RBI Fintech regulation.

Compliance Audits and Gap Analysis

- Conducting thorough audits to identify compliance gaps.

- Providing actionable recommendations to align operations with Fintech regulatory requirements in India.

Risk Management and Governance

- Implementing risk assessment frameworks for operational, financial, and cybersecurity risks.

- Establishing robust governance practices to ensure accountability.

Data Privacy and Cybersecurity Compliance

- Ensuring compliance with data protection laws, including the Personal Data Protection Bill (PDPB).

- Advisory on cybersecurity frameworks to safeguard sensitive financial data.

Training and Awareness Programs

- Conducting workshops and training sessions on Fintech compliance checklist essentials.

- Enhancing internal awareness about Fintech regulatory compliance and best practices.

Our Fintech Compliance Services

Our team of experienced consultants delivers end-to-end Fintech compliance solutions to help you stay ahead of regulatory challenges. Explore our services:

Regulatory Compliance Frameworks

- Developing customized compliance frameworks in line with RBI guidelines and Fintech regulations in India.

- Ensuring adherence to the Prevention of Money Laundering Act (PMLA), KYC norms, and other regulatory requirements.

Licensing and Registration Support

- Assistance in obtaining required licenses such as Payment Aggregator (PA), Prepaid Payment Instrument (PPI), and Non-Banking Financial Company (NBFC) licenses.

- Advisory on ongoing compliance requirements post-licensing under RBI Fintech regulation.

Compliance Audits and Gap Analysis

- Conducting thorough audits to identify compliance gaps.

- Providing actionable recommendations to align operations with Fintech regulatory requirements in India.

Risk Management and Governance

- Implementing risk assessment frameworks for operational, financial, and cybersecurity risks.

- Establishing robust governance practices to ensure accountability.

Data Privacy and Cybersecurity Compliance

- Ensuring compliance with data protection laws, including the Personal Data Protection Bill (PDPB).

- Advisory on cybersecurity frameworks to safeguard sensitive financial data.

Training and Awareness Programs

- Conducting workshops and training sessions on Fintech compliance checklist essentials.

- Enhancing internal awareness about Fintech regulatory compliance and best practices.

Why Choose NBFC Advisory?

Industry Expertise:

Our consultants bring deep knowledge of Fintech compliance in India, staying updated with the latest RBI guidelines and Fintech regulations.

We understand that each Fintech company is unique. Our solutions are customized to meet your specific operational and regulatory needs.

From licensing to audits and ongoing compliance, we provide end-to-end support to ensure seamless adherence to Fintech regulatory requirements.

We help you anticipate regulatory changes and adapt quickly, minimizing risks and ensuring business continuity.

Schedule 30-minute call with our expert

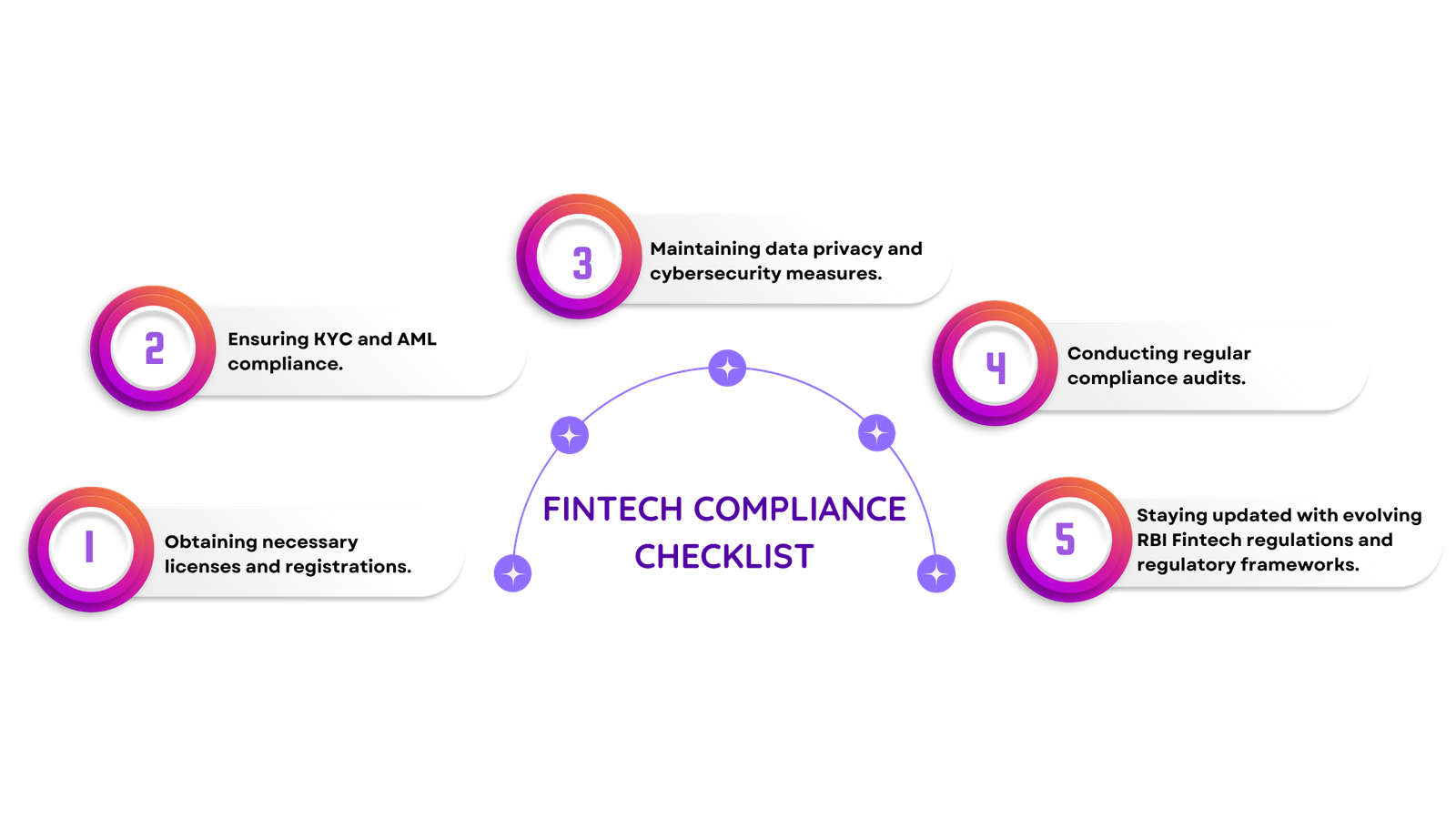

Your Fintech Compliance Checklist for India

To operate successfully, Fintech companies must adhere to a stringent compliance checklist, which includes:

Partner with NBFC Advisory for Trusted Compliance Solutions

In an industry where compliance is the foundation of trust and innovation, having a reliable partner is crucial. NBFC Advisory is committed to empowering Fintech companies with cutting-edge compliance solutions that drive growth and resilience. Whether you’re a startup or an established player, our Fintech compliance services in India are designed to support your journey towards regulatory excellence.