Get your NBFC Registered now!

Want to form a non-banking financial company (NBFC) incorporated under the Companies Act and provides credit services such as loans, deposits, leasing, hire purchase, retirement planning, and security?

- Request a call back

Overview of NBFC Registration

Non-banking financial companies, or NBFCs, are heavily involved in economic activities such as secured and unsecured loans, marketplace lending, investments, or information service providers, among other things, as defined by Section 45-IA of the RBI Act, 1934, and the Companies Act, 2013. NBFCs are distinct from commercial and cooperative banks in that they do not require a banking license but must adhere to the Reserve Bank of India's (RBI) Rules and Regulations.

Want to know the 3 Core C's for NBFC Registration?

Types of NBFC

Investment and Credit Company is a company registered under the Companies Act, 2013 with its the primary business of loans and advances, asset finance, and providing finance for any activity other than the acquisition of its securities; it is also not classified as an NBFC in any other category. It is a consolidated version of prior forms such as Loan Company, Investment Company, and Assets Finance Company, allowing a single firm to carry out all three activities under the ICC brand. This firm requires a Net Owned Fund of INR 2 Crore to be started.

It’s an expanded version of the Infrastructure Finance Companies, and IFC can only be a Sponsor for this Debt Fund. IDF is a corporation controlled by the Reserve Bank of India and registered under the Companies Act, 2013. It facilitates the flow of long-term loans into infrastructure projects and can raise funds by issuing rupee or dollar-denominated bonds with a minimum duration of five years.

The MGC company’s primary goal is to provide a mortgage guarantee. Such businesses must get at least 90% of their revenue from mortgage guarantee business or at least 90% of their gross income from mortgage guarantee business. With a Net Owned Fund of INR 100 crore, MGC can get started.

A NOFHC is a financial business organisation that will allow companies or groups to establish a new bank and all other financial services firms regulated by the RBI or other financial sector regulators.

Micro Finance Institutions (NBFC-MFI) are non-deposit taking financial institutions having net owned funds of at least Rs.5 crore (for the North Eastern Region of India, it will be Rs. 2 crores). To remain MFI, it must have Qualifying Assets that account for at least 85% of its total assets. Loans disbursed to borrowers with a rural family income of not more than INR 125k or an urban and semi-urban household income of not more than INR 200K qualify as qualifying assets; the loan will be extended without collateral.

NBFC-Factors is a financial institution with a minimum net worth of Rs 5 crores whose primary business is the acquisition of receivables on discount or the financing of such receivables through loans or advances or the creation of security interests over such receivables, but does not include typical bank lending.

CIC NBFCs are involved in the acquisition of securities and shares, with shares and equity accounting for 90% of their total assets. The minimum asset size required is INR 100 crore.

This is a new generation of tech-driven NBFC that runs a common platform for lenders and borrowers rather than lending on its own. The website brings together both lenders and borrowers. Participants are onboarded into the platform and then can conduct transactions through it. A net owned fund of INR 2 crore is also required.

The NBFC Account Aggregator is a relatively new concept in the industry. NBFC Account Aggregator collects data from several users and distributes it to various financial institutions. An Account Aggregator’s responsibilities include supplying consumers with financial information that is aggregated and easily accessible. The NBFC Account Aggregator delivers accurate data.

Recent Ammendment:

As per a recent notification issued by RBI on October 22, 2021; – Regulatory minimum Net Owned Fund (NOF) for NBFC-ICC, NBFC-MFI and NBFC-Factors shall be increased to from ₹2 crore to ₹10 crore

Which entities in India are not NBFCs?

An NBFC in India does not include the following entities as their primary business:

Agriculture activity

Industrial activity,

The purchase and sale of any items, and the purchase, sale, or

Construction.

Role of NBFC in Revolutionising the Economy

- Inclusive Growth of Financial Sector

- Mobilisation of Resources – Maintains liquidity in the Economy

- Capital Formation – Aids to increase capital stock of a company

- Provision of Long-term Credit and specialised Credit

- Help in development of Financial Markets

- Helps in Attracting Foreign Direct Investments

- Helping in Boosting the Technology introduction of Fintech Models

- Helps in Uplifting the Employment sector

- Helps in Breaking Vicious Circle of Poverty by serving as government’s instrument and providing loan to weaker sections of society

Functions of an NBFC in the Financial Sector

- Hire Purchase Services:- A hire purchase service is a way for a seller to deliver goods to a buyer without transferring ownership of the goods. Instalments are used to pay for the items. When the buyer has paid all of the goods’ instalments, the buyer instantly gains ownership of the goods.

- Retail Financing:- Corporations that provide short-term cash for loans against equities, gold, and real estate, primarily for personal consumption.

- Infrastructure Financing: This is the essential component that non-banking financial companies dominate. This segment alone accounts for many of the funds lent throughout the various segments. This category includes railways or metros, real estate, ports, flyovers, and airports, among other things.

- Asset Management Firms: Asset Management Companies (AMCs) employ fund managers (who invest in equity shares to make a profit) to invest and actively manage funds collected from small investors.

- Venture Capital Services: These companies invest in small enterprises and are still in the early stages of development, but their success rate is strong, and they can provide adequate returns in the future.

- Leasing Services:- Organizations that engage in leasing properties to small businesses or even larger ones who can’t afford it for whatever reason. The sole distinction between renting and leasing is that leasing agreements are for a specific time period.

- Micro Medium Medium Enterprise (MSME) Financing:- MSME is one of the foundations of our economy, and millions of people rely on it for a living, so the government has introduced enticing plans to stimulate its growth.

- Trade Finance:-

NBFC Registration Process

- To begin, register your business under the Companies Act of 1956/2013.

- You must maintain the company’s minimum net owned funds by the NBFC type.

- Fill out the application form on the Reserve Bank’s official website.

- Along with the application, submit the documents required for such registration.

- When you submit your application, you will receive a CARN number that will allow you to track the status of your application.

- You must send the application form to the Reserve Bank’s regional office.

- Registration will be granted if your application for NBFC Registration meets the regulatory authority’s minimum requirements.

Schedule A Call with our Experts

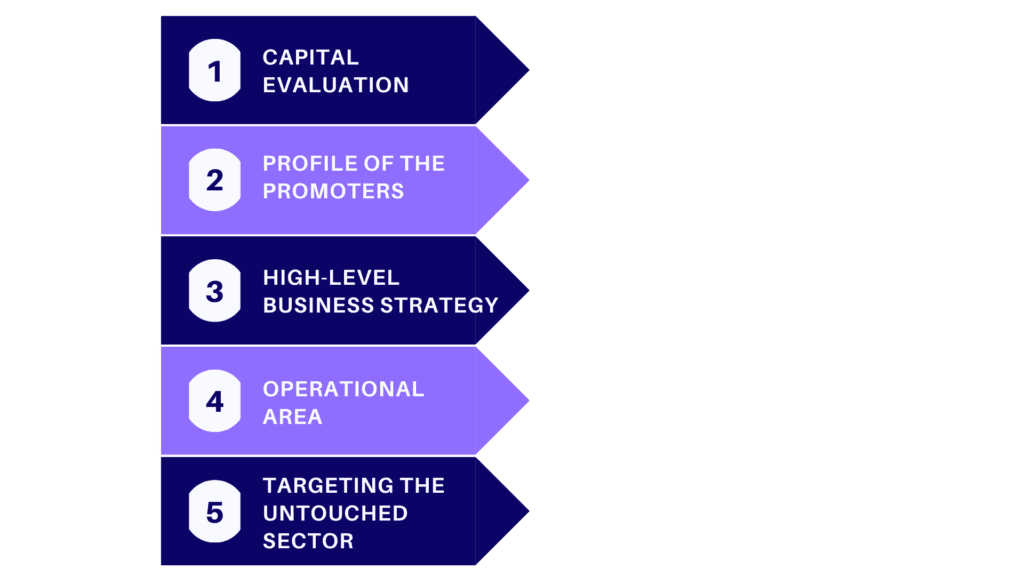

NBFC Registration Pre-Requisites

- Capital Evaluation:- The quality of capital is just as crucial as the correct board composition. The seed investment should come from reputable sources and be proportionate to the Net Worth declaration and certification.

- Profile of the Promoters:- Directors As the Company’s face, the Promoters Directors must be persons of great integrity and knowledge. It is not required for all Directors to have a background in banking or finance. However, it is intended that 25% of the Board would have a financial background.

- High-Level Business Strategy:- A thorough business strategy is the NBFC license’s lifeline. It will take the shape of a five-year road map. With the proliferation of lending institutions across the country, it is critical to provide licences to legitimate and skilled promoters.

- Operational Area: Although many areas of the nation lack basic banking facilities, select high-priority areas will be prioritised and addressed as soon as possible. Creating an NBFC in a Tier-2, Tier-3, or Tier-4 city will make licensure a little smoother.

- Targeting the Untouched Sector:- The forthcoming NBFCs will target the population segment that is unable to get loan facilities due to a poor credit rating or a lack of documents. NBFC must implement a well-planned risk management strategy to limit risks.

Advantages of NBFC Registration in India

In India, there are several advantages to registering as a non-banking financial company (NBFC).

- Loans and other financial options are available.

- Because they invest less, NBFCs are more profitable than private and public sector banks.

- The application process is less complicated than those of other banks or lending institutions.

- When compared to banks, the loan processing feature takes less time

- NBFCs assist in the management of stock and share portfolios.

- It aids in the trading of money market instruments.

- The CIBIL or credit score is not a barrier to obtaining a loan.

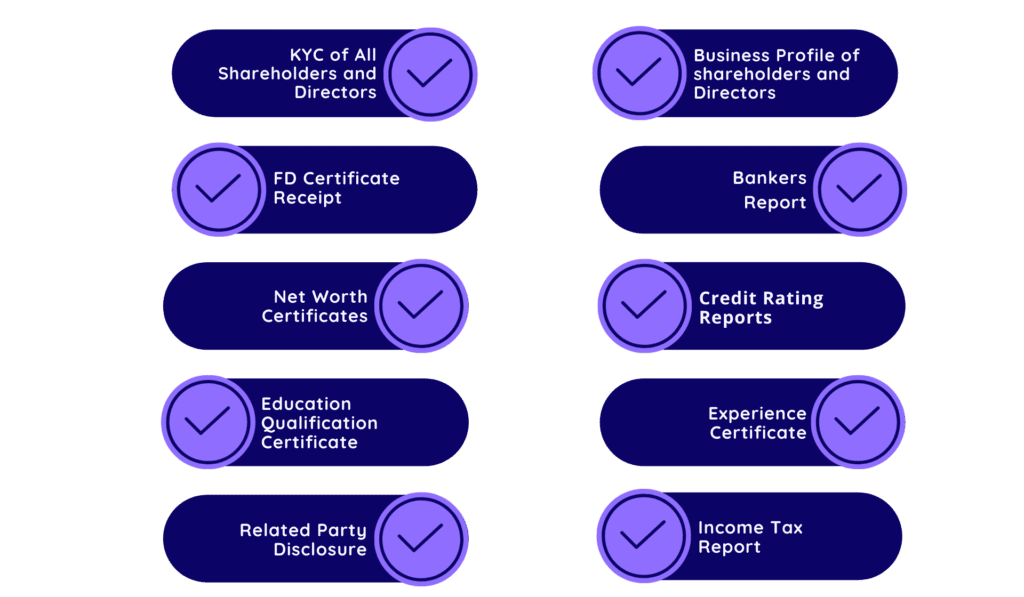

Documents Required for NBFC Registration

The following documents are required for NBFC Registration as follows:

- KYC of All Shareholders and Directors

- Business Profile of shareholders and Directors

- FD Certificate Receipt

- Bankers Report

- Net Worth Certificates

- Credit Rating Reports

Get started on your NBFC registration right now!!

Get started on your NBFC registration right now!!

FAQs

NBFCs are the Non- banking finance company that can lend and take a deposit from the public. These are the companies which are allowed to do some banking activities without having a banking license.

There are majorly two types of NBFC

- Deposit Taking NBFC :- NBFC is allowed to take a deposit from the public and can lend through public and own funds like Bajaj Finance

- Non- Deposit taking NBFC :- NBFC is not allowed to take a deposit from the Public and will conduct lending only through its funds, e.g. Parfait Finance and Investment Private Limited and Davinta Finserv Private Limited.

For Registering the NBFC, An application needs to be made to RBI. However, RBI, after considering the valid ground of the application, RBI may issue the license. Those grounds are as follow: –

- Composition of the board of directors

- Source of Capital to invest in NBFC

- No promoters or associated person shall be convicted of CIVIL and Criminal offences, including section 138 of the negotiable instrument Act.

Yes, to lend money at the pan India Level, you must have either a banking license or Non- Banking finance Company license from RBI.

Based on Nature

S.No. | Nature | Count |

1. | NBFC Accepting Deposit | 558 |

2. | NBFC Not Accepting Deposit | 9446 |

Based on Activities

S.No. | Activities | Count |

1 | NBFC- MFI | 97 |

2 | NBFC – Infrastructure Debt fund | 3 |

3 | NBFC- Factor | 8 |

4 | NBFC- Core Investment company | 59 |

5 | NBFC- Assets Finance Company | 278 |

6 | NBFC- Infrastructure Finance company | 9 |

7 | NBFC -P2P Lending | 25 |

8 | NBFC – ARC | 29 |

9 | NBFC-ICC | 9346 |

10 | NBFC Assets Size 100 crore and above | 946 |

11 | NBFC-Account Aggregator | 5 |

12 | NBFC – Non operating financial holding company | 3 |

Note :- The difference in total due to various different dates on RBI website for the data updation . You may visit to www.rbi.org.in for the lates list.

The minimum Capital requirement to register the NBFC is 10 Crore or more however if the existing NBFC who is holding a valid license before 22nd Oct 2021 are required to maintain the NOF 5 crore by March 2025 and 10 crores by March 2027

However, for NBFC-P2P, NBFC-AA, and NBFCs with no public funds and no customer interface, the NOF shall continue to be ₹ 2 crores. It is clarified that there is no change in the existing regulatory minimum NOF for NBFCs – IDF, IFC, MGCs, HFC, and SPD.

There are the following documents required for the NBFC Registration :-

- KYC of the directors and shareholders

- CIBIL report of the Directors and Shareholders

- Business plan for 3 to 5 years with financial projections

- Net worth statement and ITRs for the shareholders and directors cum shareholders

- Profile of the directors

- Financials experience background of the directors.

- Board resolution to start business

- And various other documents as per profile of the directors

For more details please email to us info@nbfcadvisory.com