Inside This Article

With financial fraud and money laundering risks on the rise, Non-Banking Financial Companies (NBFCs) must strictly comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. The Reserve Bank of India (RBI) and the Financial Intelligence Unit – India (FIU-IND) enforce these compliance measures to ensure financial integrity, prevent fraud, and protect the Indian economy from illicit activities.

Non-compliance can result in hefty penalties, operational restrictions, and reputational damage. In 2024, FIU-IND imposed significant fines on multiple NBFCs, reinforcing the need for robust AML & KYC frameworks.

In this blog, we provide:

- A detailed AML & KYC compliance checklist for NBFCs.

- RBI & FIU-IND guidelines for AML & KYC adherence.

- Consequences of non-compliance and real-world case studies.

- Best practices to ensure full compliance and avoid penalties.

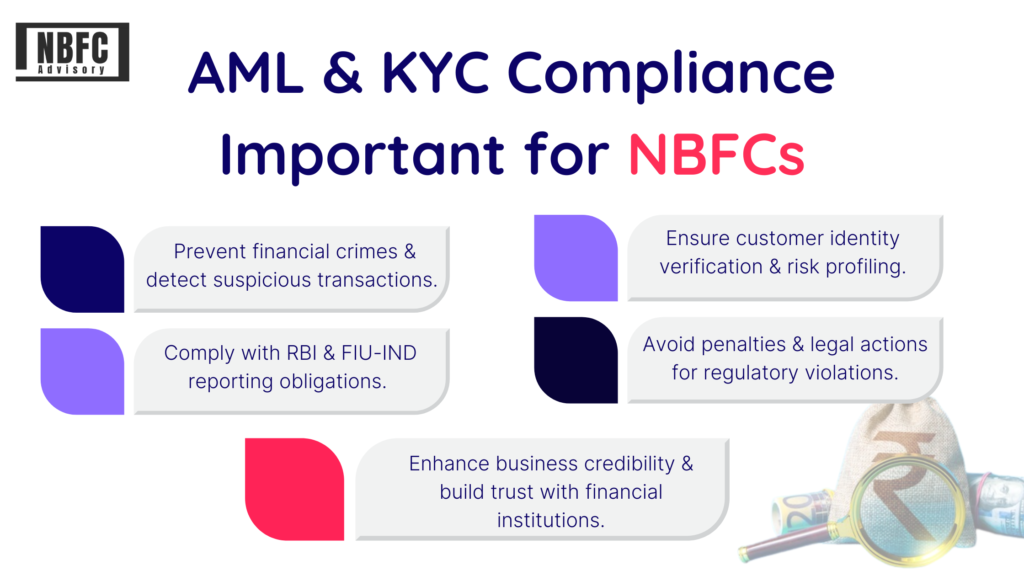

Why is AML & KYC Compliance Important for NBFCs?

NBFCs are prime targets for money laundering, financial fraud, and identity theft. They must implement strict AML & KYC measures to:

- Prevent financial crimes & detect suspicious transactions.

- Ensure customer identity verification & risk profiling.

- Comply with RBI & FIU-IND reporting obligations.

- Avoid penalties & legal actions for regulatory violations.

- Enhance business credibility and build trust with financial institutions.

Example: In October 2024, FIU-IND fined PC Financial Services ₹2,000 crore for violating AML & KYC norms and transferring funds to China without regulatory approval【source】

AML & KYC Compliance Checklist for NBFCs

Customer Due Diligence (CDD) & KYC Compliance

- Verify customer identity (KYC) before onboarding.

- Obtain PAN, Aadhaar, Passport, Voter ID, or any RBI-approved document for KYC verification.

- Conduct Video KYC (V-KYC) for remote onboarding.

- Store KYC documents digitally and ensure data security.

- Periodically revalidate KYC details for high-risk customers.

- Report customers who fail to provide KYC documentation to FIU-IND.

Regulatory Reference: RBI Master Direction – KYC 2023 mandates KYC updates every two years for high-risk customers, eight years for medium-risk, and ten years for low-risk customers.

Enhanced Due Diligence (EDD) for High-Risk Customers

- Classify customers into Low, Medium, and High-Risk Categories.

- Identify Politically Exposed Persons (PEPs) and conduct strict due diligence.

- Perform background checks for customers with multiple loan defaults.

- Monitor transactions of individuals from high-risk countries as per FATF guidelines.

- Escalate high-risk transactions for manual review before loan approval.

Case Study: In 2023, an NBFC was penalized for granting loans to entities linked to financial fraud without proper EDD verification.

Monitoring & Reporting Suspicious Transactions to FIU-IND

- Monitor all transactions exceeding ₹10 lakh.

- Identify unusual account behavior or multiple small transactions (structured transactions).

- Detect high-value cash transactions with no legitimate business purpose.

- Flag accounts where customer identities do not match their financial behavior.

- Submit Suspicious Transaction Reports (STRs) to FIU-IND within the prescribed time.

- Ensure real-time fraud detection using AI-based monitoring tools.

Regulatory Reference: As per Prevention of Money Laundering Act (PMLA), 2002, NBFCs must report suspicious activities, large cash transactions, and cross-border fund transfers.

Transaction Limits & Cross-Border Monitoring

- Report cash transactions over ₹10 lakh to FIU-IND.

- Monitor cross-border transactions above ₹5 lakh to prevent illicit fund transfers.

- Verify source of funds for large transactions before processing.

- Identify unusual transactions in inactive accounts.

- Maintain detailed transaction records for 5+ years for regulatory audits.

Compliance with CERSAI & CKYC Norms

- Register all secured loans with CERSAI to prevent fraudulent lending.

- Upload borrower details to CKYC (Central KYC Registry) within 3 days of loan disbursement.

- Maintain a unified KYC record to avoid duplication & fraud risks.

- Ensure NBFC compliance with CKYC guidelines for seamless credit history tracking.

Regulatory Reference: CERSAI & CKYC registration is mandatory for NBFCs as per RBI’s KYC Master Direction, 2023.

Internal AML Policy & Compliance Framework

- Develop a company-wide AML/KYC policy approved by the Board.

- Assign a Principal Compliance Officer responsible for AML reporting.

- Implement AI-driven fraud detection systems for real-time monitoring.

- Conduct quarterly internal audits to detect compliance gaps.

- Train employees on RBI KYC norms, AML rules, and fraud detection techniques.

Tip: Many NBFCs use AI-powered compliance management software to detect fraud & automate reporting.

Consequences of Non-Compliance with AML & KYC Regulations

What happens if an NBFC fails to follow AML & KYC guidelines?

- Regulatory Penalties: RBI imposes fines up to ₹10 Lakh per day for violations.

- License Cancellation: FIU-IND can blacklist or suspend NBFC licenses.

- Reputational Damage: Customers & investors lose trust in non-compliant NBFCs.

- Increased Fraud Risks: Poor compliance makes NBFCs vulnerable to financial crimes.

Recent Example: In January 2025, FIU-IND imposed a ₹9.27 crore fine on Bybit Fintech Ltd. for operating without AML compliance【source】.

How to Stay Fully AML & KYC Compliant?

- Register with FIU-IND & submit STRs on time.

- Implement AI-based AML transaction monitoring tools.

- Conduct regular internal audits & KYC verification.

- Monitor high-risk transactions & prevent money laundering.

- Train compliance officers & employees on AML guidelines.

Need an expert to handle your NBFC AML & KYC compliance?

Schedule a Compliance Consultation with Our Experts!

Stay AML Compliant & Protect Your NBFC from Regulatory Risks!

Final Thoughts

With RBI tightening AML & KYC regulations, NBFCs must adopt a proactive compliance approach. A strong AML & KYC framework helps prevent fraud, ensures regulatory compliance, and enhances customer trust.

By following this comprehensive compliance checklist, NBFCs can:

✔ Avoid hefty penalties & license restrictions.

✔ Ensure full compliance with RBI, FIU-IND & PMLA norms.

✔ Build a fraud-free & trusted financial ecosystem.

Need NBFC compliance assistance? Let’s connect!

📞 Call Us: +91 93287 18979 | 🌐 Visit: nbfcadvisory.com