The NBFC sector has grown into one of the strongest pillars of India’s lending system. NBFCs now give loans for almost everything from small consumer needs to MSMEs, from micro-credit to big project loans. They reach people and areas where many banks still cannot. Because of this huge reach and growing influence, the Reserve Bank of India keeps a close eye on how NBFCs operate.

And here’s the thing 2025 has been a big year for regulatory updates. RBI has not only tightened the rules but also reorganised and simplified many older guidelines. If you work in lending, finance, accounts, audit, risk, or compliance, you can’t ignore these changes. You need to understand them to keep your NBFC safe and running smoothly.

Let’s break this down clearly, in simple language, in a way any reader, whether a beginner or a seasoned professional can understand. Along the way, I’ll naturally use the keywords you asked for: Compliance, NBFC, and NBFC compliance.

Why RBI Brought These Updates in 2025

Before we dive into the details, let’s understand the “why.”

The NBFC landscape has changed drastically in the last few years:

- Loan books have grown fast

- Digital lending has exploded

- Some NBFCs have faced liquidity crunches

- A few had governance lapses

- Borrower complaints have increased

- New types of financial products have emerged

RBI needed to make sure the system stays healthy and stable. So in 2025, it introduced a fresh set of updates that aim to create:

- Stronger governance

- Better transparency

- Safer lending practices

- Cleaner balance sheets

- Clearer rules across the sector

In short, RBI wants NBFCs to grow, but with discipline. And this is where NBFC compliance steps in.

RBI Consolidated Thousands of Old Circulars

Let’s start with the update that hardly gets attention outside compliance teams but is actually one of the biggest changes of the decade.

For years, NBFC regulations were scattered across hundreds of circulars. Some were outdated, some overlapped, some had been partially replaced, and some were simply confusing.

In 2025, RBI cleaned house by:

- Removing thousands of old circulars

- Reorganising important rules into a smaller set of Master Directions

- Making NBFC guidelines easier to find and follow

Why this matters

NBFC compliance has always been tricky because teams had to dig through old and new documents to confirm a single rule.

Now, with consolidated Master Directions, everything is clearer:

- No more confusion

- No more mixed interpretations

- No more searching through decade-old circulars

This also means RBI expects higher accuracy. When the instructions are clearer, regulators are less tolerant of mistakes.

Updated NBFC Classification under Scale-Based Regulation

The Scale-Based Regulatory (SBR) framework is the backbone of NBFC monitoring in India. In simple terms, RBI groups NBFCs based on their size, risk, and importance. These groups are:

- Base Layer – smaller NBFCs

- Middle Layer – medium NBFCs

- Upper Layer – systemically important NBFCs

- Top Layer – usually empty unless a serious risk emerges

In 2025, RBI updated the list of NBFCs placed in the Upper Layer.

Why this matters

NBFCs in the Upper Layer face:

- Stricter reporting

- Higher governance standards

- More detailed disclosures

- Tighter supervision

- Stronger capital requirements

If your NBFC has recently moved into the Upper Layer, your compliance workload will increase. NBFC compliance is now everyone’s job in the company, not just the compliance officer’s.

Capital Adequacy and Risk-Weight Norms Made Stricter

RBI updated how NBFCs must calculate capital, recognise risks and maintain financial strength.

A few areas where rules changed include:

- Treatment of Right-of-Use (ROU) assets

- Risk weights for loans given to NBFCs

- Treatment of project finance exposures

- Calculations of credit risk and operational risk

Why this matters

Capital rules decide how safe an NBFC’s balance sheet is. If risk weights go up, the NBFC must hold more capital. If capital goes down, lending limits shrink.

This directly affects:

- Business expansion

- Loan book growth

- Borrowing capacity

- Investor confidence

So, NBFCs must revisit their capital models immediately. Strong capital planning is now a core part of NBFC compliance.

Major Update: The Project Finance Directions 2025

This is one of the biggest and most detailed updates of the year. If your NBFC gives loans for big projects like buildings, roads, or real estate, you need to pay close attention to these rules.

RBI introduced a new, uniform rulebook for project finance. The new rules cover:

- How project loans must be appraised

- Mandatory monitoring of project progress

- How to deal with delays

- DCCO (Date of Commencement of Commercial Operations) guidelines

- Provisioning rules

- Risk weight norms

- Documentation requirements

Why this matters

Project finance is high risk. A delay in construction, regulatory approvals, or cash flow can turn a performing loan into a non-performing loan.

The new directions protect lenders by ensuring:

- Better appraisal

- Closer monitoring

- Earlier detection of delays

- Stronger provisioning

- Cleaner balance sheets

This area alone increases NBFC compliance work significantly.

Group Exposure & Core Investment Company (CIC) Rules Tightened

Many NBFCs sit within large business groups. Historically, This has caused problems like loans moving between group companies, unclear limits, risky investments, and confusing ownership setups.

In 2025, RBI tightened:

- Group-level exposure rules

- Governance standards for CICs

- Accounting norms

- Inter-company lending limits

- Disclosure requirements

Why this matters

RBI wants to make sure NBFCs are not used to support weaker group companies.

For NBFC compliance teams, this means:

- Closer tracking of group transactions

- Proper documentation

- Transparent reporting

- Avoiding excessive exposure to related parties

If your NBFC is part of a complex group, these updates are especially important.

New Rules for Fair Lending and Customer Transparency

Borrower complaints have increased in the last few years, especially with the rise of digital lending. RBI stepped in with stronger rules to protect customers.

The 2025 update makes it compulsory to provide a Key Facts Statement (KFS) for all loans.

This statement must clearly show:

- Total interest

- All charges and fees

- Recovery practices

- Repayment schedule

- Customer rights

RBI is pushing for full transparency no hidden charges, no unclear terms, no complicated language.

Why this matters

This directly affects loan operations, marketing, sales, and customer support. Compliance teams must make sure every department follows the rules.

This is where NBFC compliance becomes organisation-wide, not just policy-driven.

RBI’s Enforcement Has Become Tougher

If you look at the recent trends, RBI has increased penalties on both banks and NBFCs.

What are the common reasons?

- Incomplete KYC

- Incorrect reporting

- Wrong classification of loan assets

- Violations of exposure limits

- Weak IT systems

- Poor governance practices

- Delayed regulatory filings

What this means in plain language

RBI is done with warnings. Now, it acts fast.

If an NBFC ignores compliance rules, the penalty is immediate and public damaging reputation and investor trust.

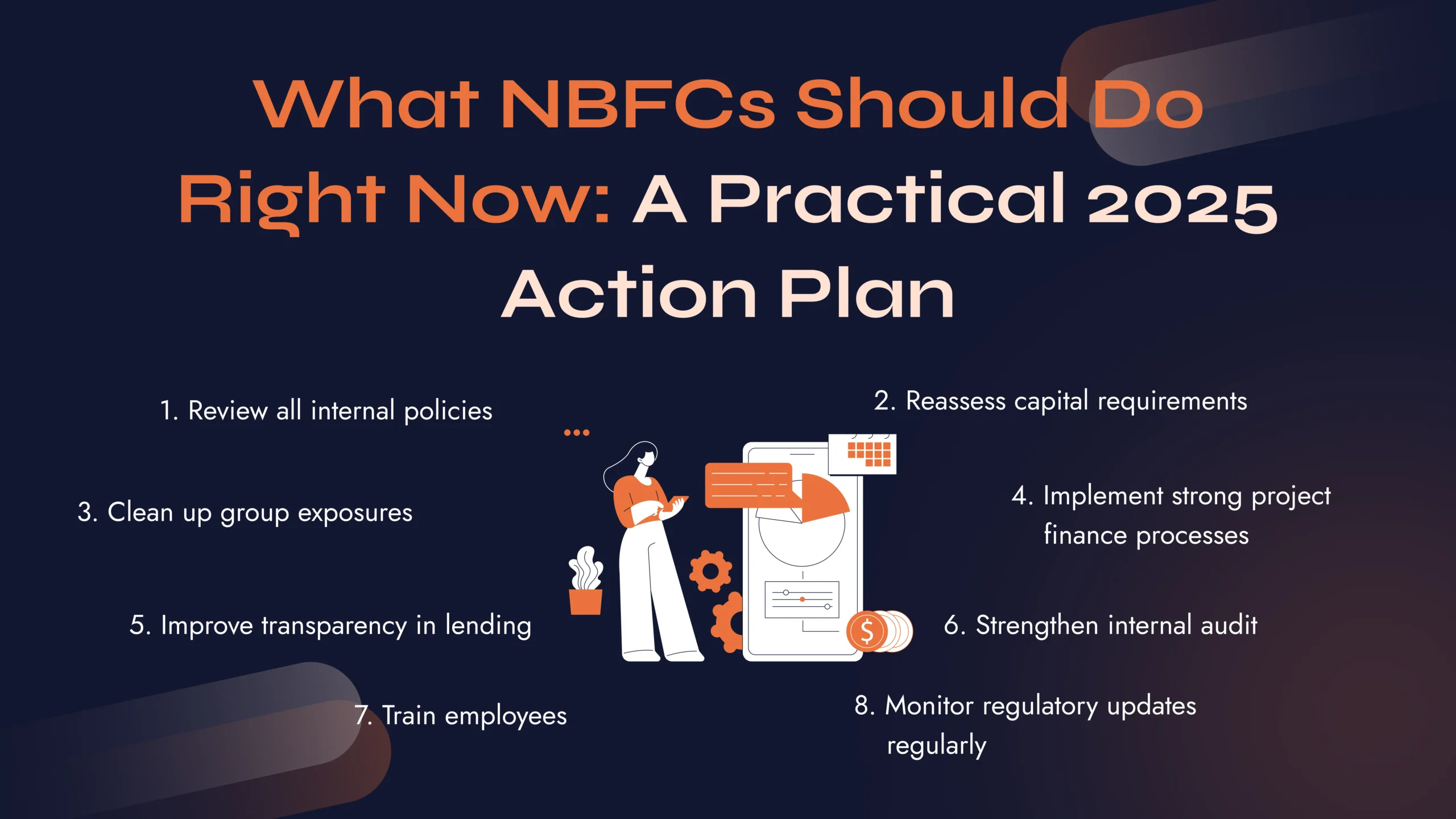

What NBFCs Should Do Right Now: A Practical 2025 Action Plan

Here’s a simple checklist any NBFC can use to stay aligned with the 2025 updates.

Review all internal policies

Update your credit rules, risk rules, compliance guides, loan papers, KFS forms, and reporting templates.

Reassess capital requirements

Make sure your NBFC meets the updated capital and provisioning rules.

Clean up group exposures

Review all inter-company transactions and ensure they follow the new limits.

Implement strong project finance processes

If your NBFC offers project loans, upgrade documentation and monitoring immediately.

Improve transparency in lending

Ensure every loan product has a proper Key Facts Statement.

Strengthen internal audit

Audits must now be deeper, more frequent and more technology-driven.

Train employees

Frontline staff, credit officers, auditors, risk teams everyone must understand the new rules.

Monitor regulatory updates regularly

RBI updates things quietly, often through circulars. Staying updated is a core part of compliance.

Know More: RBI Compliance Checklist for NBFCs

Why These Changes Are Good for NBFCs

It’s easy to think regulation slows business down. But the truth is, strong regulation strengthens trust. And trust brings:

- Better credit ratings

- Easier fundraising

- Stronger investor confidence

- Lower borrowing costs

- More stable growth

When NBFCs follow good compliance systems, they get better partners and stay stronger in the long run.

Final Thoughts

The NBFC sector in 2025 is entering a more disciplined, transparent and structured era. RBI is not trying to restrict growth. It’s trying to ensure healthy, stable and sustainable growth.

For NBFCs, this is the moment to strengthen their governance, systems, risk management and compliance culture.

In simple terms: NBFC compliance is no longer paperwork it’s a business strategy.

Here’s Your Next Step.

If all these regulatory changes feel overwhelming, you’re not alone. Most NBFCs, even the big ones, are still trying to understand how the 2025 rules will change their daily work, loan plans, money needs, and future plans.

This is where the right guidance can make all the difference.

If you are updating your rules or preparing for an RBI check, experts can help you save time, stay safe, and do better.

Our NBFC Advisory Team can help you with:

- Compliance reviews & regulatory gap audits

- Updating policies as per the new Master Directions

- Capital adequacy and risk-weight recalculations

- Project finance onboarding under 2025 rules

- Governance and board-level compliance support

- Group exposure monitoring and documentation

- KYC, fair-lending and consumer-protection alignment

- Ongoing NBFC compliance management

If you want your NBFC to follow the rules and be ready for RBI checks without slowing your work, getting help from experts is a good idea.

Ready to strengthen your NBFC’s compliance for 2025 and beyond?

Reach out to our NBFC Advisory Team and let’s build a stronger, safer and fully compliant future for your organisation.

📞 Call NBFC Advisory: +91 93287 18979

🌐 Visit: nbfcadvisory.com