The NBFC sector has undergone a significant transformation in the lending landscape with the advent of digitalization. Automation has revolutionized various aspects of NBFC operations, such as customer acquisition and verification. However, the credit risk underwriting process, which determines the borrower’s creditworthiness, is still heavily reliant on manual assessment in many NBFCs. This manual approach leads to delays in loan approvals and poses an increased risk of defaults and non-performing assets (NPAs). This article explores how technology can enhance the credit risk underwriting process for NBFCs, enabling faster and more streamlined lending procedures.

Understanding Credit Risk Underwriting

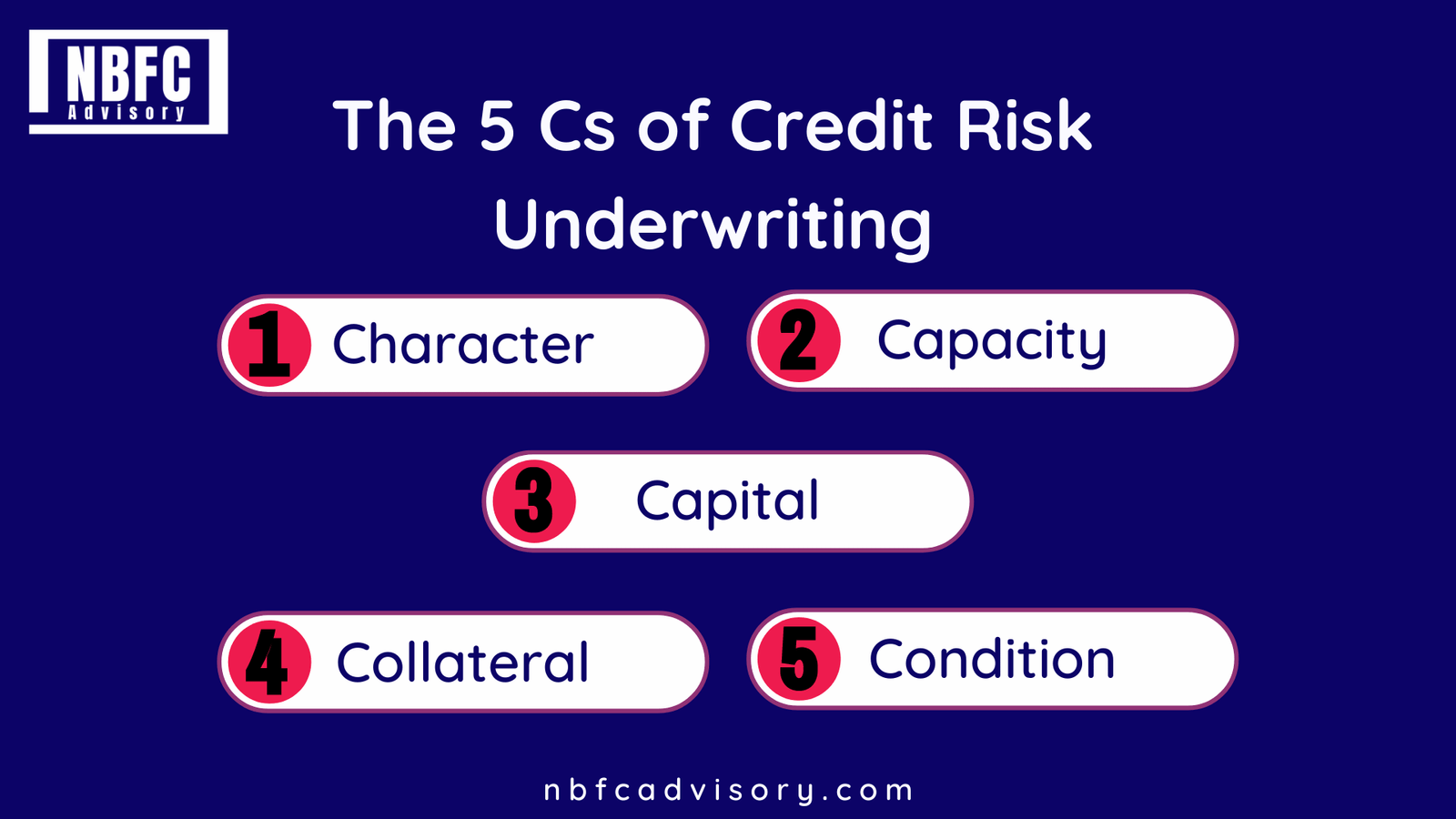

The 5 Cs of credit risk underwriting—Character, Capacity, Capital, Collateral, and Conditions—serve as a consolidated framework for assessing a borrower’s creditworthiness.

Credit risk underwriting involves evaluating a borrower’s personal, financial, or business information to assess their creditworthiness and the likelihood of loan repayment failure. The process includes verifying Know Your Customer (KYC) documents and conducting a detailed assessment of the applicant’s credit report based on well-established benchmarks.

- Character: This refers to the borrower’s credit history, accumulated through credit cards or loans. NBFCs analyze credit reports and scores, considering factors such as foreclosures, late payments, and bankruptcies. A higher credit score indicates lower credit risk.

- Capacity: Capacity assesses the borrower’s ability to repay the loan, typically evaluated through the debt-to-income ratio (DTI). A higher DTI indicates a lower credit risk, influencing loan approval decisions.

- Capital: Capital encompasses the borrower’s assets, savings, and investments. NBFCs consider this aspect of determining the borrower’s commitment and ability to bear personal risks for their business. Utilizing personal capital reduces the chances of default.

- Collateral: Collateral refers to assets pledged by the borrower to secure the loan. NBFCs evaluate both personal and business assets, including guarantors’ assets, as alternate sources of repayment. The type of collateral depends on the loan type.

- Conditions: NBFCs consider the industry, business, and economic conditions relevant to the loan application. This assessment helps determine whether the loan proceeds will be used for working capital, renovations, additional equipment, etc., and whether the conditions are likely to continue, improve, or deteriorate.

The Need for Technology in Credit Risk Underwriting Process

NBFCs have recognized the need to adopt automated credit risk underwriting processes due to several reasons:

- Meeting changing customer expectations: Traditional banks relied on physical distribution methods and manual credit score calculations, which fell short of meeting the demand for fast online credit approvals. NBFCs must revamp their credit risk underwriting processes to cater to the increasing need for speed and simplicity.

- Streamlining client interactions: The traditional process involves the manual exchange of financial information and documentation through emails, scans, and faxes, resulting in a tedious back-and-forth process. Customer-facing interactive portals enable the digital capture of such information. For example, video KYC launched by the Reserve Bank of India in 2020 simplifies the verification process.

- Eliminating unnecessary manual work: The traditional credit risk underwriting process involves significant manual data entry. NBFCs can leverage portals that connect to borrowers’ financial accounting packages and possess digital tax form reading capabilities, reducing manual effort.

- Reducing decision-making delays: Manual generation of financial spreads is time-consuming. Applying innovative machine-learning technology in credit risk underwriting can expedite the process, leading to faster decision-making.

- Mitigating higher risks: Ascertainment of risks in loan applications poses a primary challenge during traditional credit risk underwriting. Agents must meticulously check applications to identify errors that can result in credit risks in the future, posing significant challenges for NBFC officials.

- Addressing cost and return pressures: Traditional banking operations, legacy IT systems, and branch networks are often costly. Fintech companies operate at lower cost-to-income ratios, challenging incumbents’ revenue and cost models. Leveraging technology helps NBFCs reduce operational costs and improve returns.

How Technology Improves Credit Risk Underwriting for NBFCs

Technology plays a crucial role in enhancing the credit risk underwriting process for NBFCs. It offers several benefits that positively impact the lending landscape:

- Reduced Turnaround Time (TAT): In today’s fast-paced world, consumers expect a fast and efficient personal loan process. Previously, manual verification processes took several working days. With innovative technologies like Video KYC, eKYC, and eSigning, digital verification can be conducted, reducing the turnaround time by up to tenfold.

- Better Decision Making: Credit scores play a vital role in assessing an individual’s creditworthiness. Automated systems utilize proprietary algorithms to evaluate applicants. These algorithms consider various elements such as CIBIL Score, FOIR, and previous loans. Social score algorithms provide deeper insights into applicants’ spending behavior, lifestyle, and employment stability, resulting in faster and more accurate decision-making.

- Enhanced scalability: Technology enables lenders to verify consumer profiles regardless of their geographical location. Tools like geo-tagging, eKYC, and online verification processes eliminate the need for physical verification by designated agents. This scalability helps NBFCs tap into untapped credit markets and expand their reach.

- Increased Inclusion: Traditional lending systems primarily focused on credit scores, often leading to the rejection of loan applications from first-time borrowers. Digital lenders consider various factors, such as income stability and job stability, providing easier access to credit for first-time borrowers when they need it the most.

Conclusion

To establish a sustainable business model in today’s digital revolution, NBFCs must streamline their processes and workflows to align with changing market dynamics. Traditional credit risk underwriting processes result in delays and inefficiencies. By replacing legacy methods with automation, NBFCs can significantly reduce the time and cost associated with processing loan applications. Automation brings about substantial improvements, delivering faster and more accurate credit risk underwriting outcomes. Embracing technology is imperative for NBFCs to stay competitive and provide efficient lending solutions in the evolving financial landscape.