Introduction: Understanding the Backbone of Credit Reporting in India

In today’s financial ecosystem, making informed lending decisions is crucial, both for financial institutions and individual borrowers. But how do banks and Non-Banking Financial Companies (NBFCs) assess someone’s creditworthiness? That’s where Credit Information Companies (CICs) step in. These specialized entities gather and maintain individuals’ and businesses’ credit data, shaping India’s financial landscape. In this post, we will explore what CICs are, how they work, and their growing importance in India’s financial sector, especially for NBFCs.

What Are Credit Information Companies (CICs)?

Credit Information Companies (CICs) are regulated entities licensed by the Reserve Bank of India (RBI) under the Credit Information Companies (Regulation) Act, 2005. They function as credit bureaus, collecting data about the credit histories of borrowers and providing comprehensive credit reports to lenders. These credit reports and credit scores help lenders make informed decisions when sanctioning loans or setting interest rates.

Key Highlights of CICs:

- Legal Framework: Regulated under the CIC Regulation Act, 2005.

- Four Major Players: CIBIL, Equifax, Experian, and CRIF High Mark are the four licensed CICs in India.

- Scope: CICs collect data from various sources, including banks, NBFCs, and other financial institutions.

Fun Fact: Did you know that in 2023 alone, CICs processed data on over 700 million credit accounts in India? This demonstrates their vast influence on India’s financial system.

How Do CICs Work? A Step-by-Step Breakdown

CICs have a structured process for collecting, analyzing, and distributing credit information. Let’s break down the workings of these credit information companies in simple terms:

- Data Collection: Banks, NBFCs, and other financial institutions regularly share credit-related data with CICs. This includes information on loan repayments, credit card usage, defaults, and other credit behaviors.

- Data Validation and Maintenance: CICs validate this data to ensure accuracy and consistency. Any discrepancies are flagged for correction.

- Credit Score Calculation: Based on the validated data, CICs use complex algorithms to calculate a credit score. This score typically ranges from 300 to 900, with a score of 750+ being ideal for securing loans with favorable terms.

- Report Generation: Credit scores are integrated into comprehensive reports, which are then provided to lenders for decision-making.

- Data Security and Privacy: CICs are responsible for safeguarding this sensitive information, ensuring data privacy and protection.

Importance of CICs for NBFCs

NBFCs play a significant role in India’s lending landscape by providing access to credit for individuals and businesses often underserved by traditional banks. For NBFCs, CICs are invaluable in assessing and mitigating credit risk. Here’s why:

- Credit Risk Assessment: CICs offer detailed insights into a borrower’s credit history, enabling NBFCs to evaluate potential risks accurately.

- Streamlined Lending Decisions: By using credit scores and reports from CICs, NBFCs can make quicker and more reliable lending decisions.

- Portfolio Diversification: CIC data allows NBFCs to identify creditworthy customers and explore new lending opportunities, leading to portfolio diversification.

Benefits of CICs for Borrowers

Credit Information Companies are not only crucial for lenders but also offer several benefits for borrowers. Maintaining a healthy credit score and credit report with CICs can open multiple avenues for securing credit on favorable terms. Let’s explore how CICs benefit borrowers:

Advantages of a Good Credit Score:

- Higher Loan Approvals: A good credit score increases the chances of loan approvals. According to industry data, borrowers with a credit score of 750 and above have an 80% higher likelihood of loan approvals.

- Lower Interest Rates: Lenders offer lower interest rates to borrowers with high credit scores, reducing the cost of borrowing.

- Better Negotiation Power: Borrowers with positive credit reports are in a stronger position to negotiate the terms and conditions of loans.

CICs in India: An Overview of Leading Players

India’s credit reporting ecosystem is dominated by four key CICs:

- TransUnion CIBIL: The oldest and most popular CIC in India, CIBIL covers over 75% of the credit market with data on more than 600 million individuals and 32 million businesses.

- Equifax: Known for its wide range of solutions, Equifax provides consumer and commercial credit information services.

- Experian: A global leader, Experian offers personalized credit reports to borrowers and advanced analytics to lenders.

- CRIF High Mark: The youngest CIC, CRIF High Mark, is rapidly gaining traction with comprehensive datasets on consumer and microfinance sectors.

Data and Trends: CICs’ Contribution to the Indian Credit Market

According to RBI’s annual report, credit disbursements in India saw a 15% increase in 2023, driven largely by data-backed lending practices. The reliance on credit scores for risk assessment has grown significantly, with nearly 90% of lending institutions using CIC data to determine creditworthiness.

Interesting Insight: CIC data indicates that personal loans accounted for 28% of the total credit market in 2023, followed by home loans at 22%. This demonstrates a shift towards unsecured lending, where credit information plays a key role in decision-making.

Challenges Faced by CICs

Despite their critical role, CICs face several challenges in the Indian market:

- Data Accuracy: Inaccurate or outdated data from lenders can affect the accuracy of credit reports, leading to disputes between borrowers and financial institutions.

- Privacy Concerns: As credit data becomes increasingly digitized, protecting sensitive borrower information against cyber threats remains a priority.

- Limited Awareness Among Borrowers: Many borrowers are unaware of how credit scores are calculated or how they impact loan eligibility.

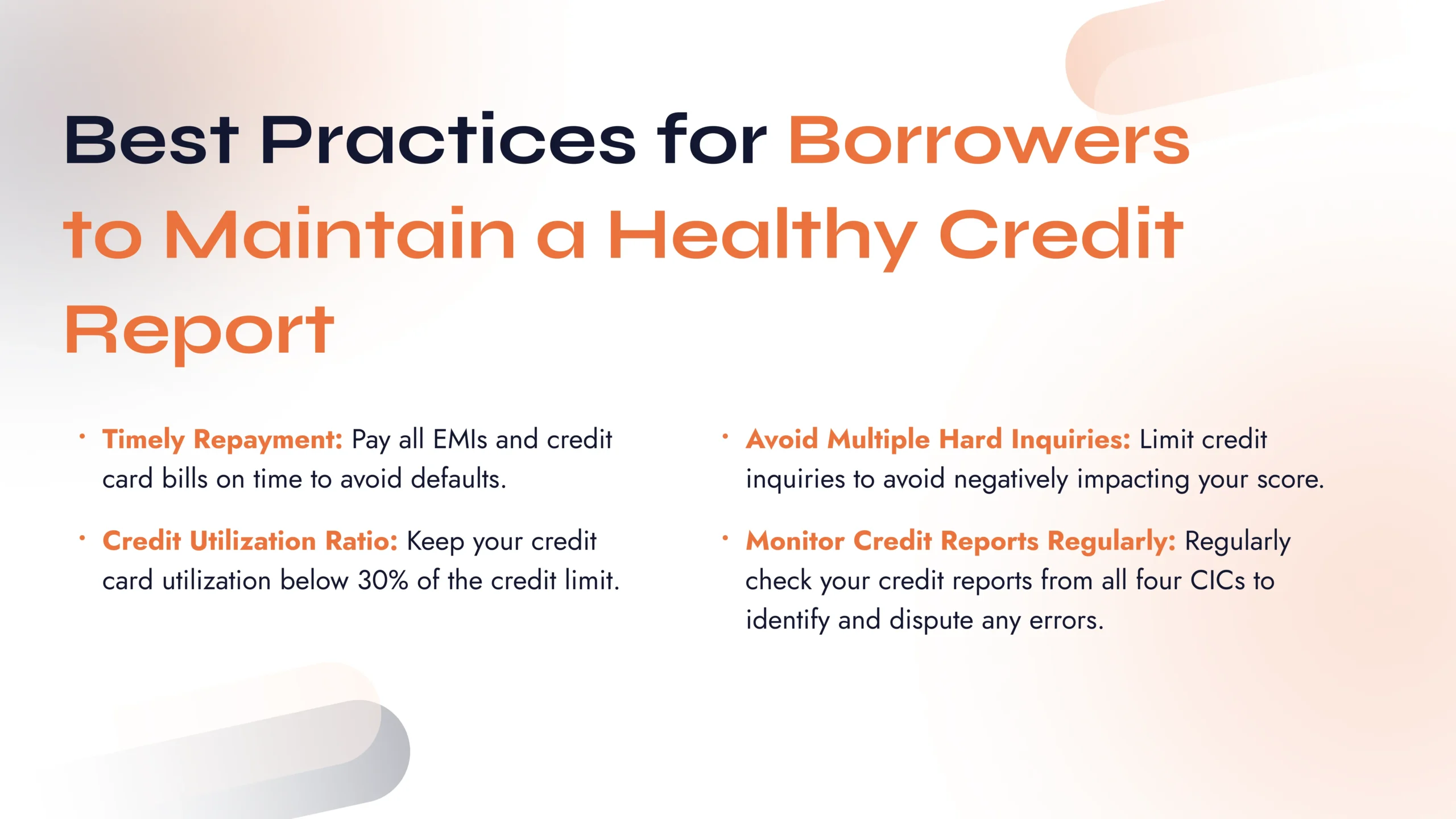

Best Practices for Borrowers to Maintain a Healthy Credit Report

Maintaining a good credit report is essential for securing loans and credit facilities. Here are some best practices for borrowers:

Visual Aid: Infographic – How CICs Help in Lending Decisions

Insert infographic showing the flow of data from lenders to CICs, followed by credit score calculation and report generation. Include alt text: “Infographic showing how Credit Information Companies (CICs) gather data and generate credit reports for lenders.”

Quotes from Industry Experts

“Credit Information Companies are transforming the lending landscape in India. Their data-driven insights are helping NBFCs offer personalized credit solutions and manage risks effectively,” says Anjali Sharma, a senior consultant specializing in financial data analytics.

Regulatory Framework: The CIC Regulation Act, 2005

CICs in India operate under the regulatory umbrella of the CIC Regulation Act, 2005, which lays down the guidelines for their operations, licensing, and data handling practices. The RBI is the key regulator responsible for overseeing and enforcing these regulations to ensure transparency and data integrity.

Future of CICs in India

As India’s financial sector continues to evolve, the role of CICs is expected to expand further. The advent of FinTech solutions and the rise of digital lending have increased the importance of accurate and comprehensive credit information. CICs are now collaborating with FinTechs and NBFCs to provide real-time insights and customized credit products.

Emerging Trends:

- Adoption of Advanced Analytics: CICs are leveraging machine learning and AI to improve credit risk assessment models.

- Focus on Financial Inclusion: CICs are working towards including unbanked and underserved segments in the formal credit system by gathering alternative data.

Call to Action: Your Next Steps to Financial Literacy

Understanding how Credit Information Companies (CICs) work can help you make better financial decisions. If you’re looking to check your credit score or improve your credit profile, take proactive steps today! Comment below with any questions, share this post with your network, and get in touch with our experts at NBFC Advisory to learn more about how CICs influence your financial journey.