Non-Banking Financial Companies (NBFCs) play a crucial role in India’s financial sector by providing services that traditional banks often overlook, such as asset financing, microfinance, and infrastructure lending.

As the Indian economy continues to grow, the demand for NBFCs has surged, making them a lucrative business opportunity.

However, establishing an NBFC in India involves navigating a complex registration process governed by the Reserve Bank of India (RBI).

This blog provides a detailed guide on the NBFC registration process, eligibility criteria, required documents, necessary licenses, and the benefits and challenges of becoming an NBFC in 2024.

Understanding NBFCs: A Quick Overview

Before diving into the registration process of NBFC, it’s important to understand what an NBFC is.

An NBFC is a financial institution that offers various banking services but does not hold a banking license. Unlike traditional banks, NBFCs cannot accept demand deposits, such as savings or current accounts, but they can offer loans, credit facilities, savings schemes, and investment products.

NBFCs are regulated by the RBI under the RBI Act, 1934, and are classified into different categories based on their activities.

Eligibility Criteria for NBFC Registration in 2024

The RBI has set forth stringent eligibility criteria for registering an NBFC to ensure that only credible entities enter this highly regulated space. As of 2024, the key eligibility criteria include:

- Minimum Net Owned Fund (NOF): The company must have a minimum NOF of ₹10 crore.

- Incorporation: The applicant must be a company registered under the Companies Act, 2013, either as a Private Limited or a Public Limited Company.

- Directors’ Expertise: At least one-third of the directors must have relevant experience in finance, particularly in banking, finance, or economic management.

- Creditworthiness: The company’s promoters and directors must have a clean credit history, free from any defaults or blacklisting by financial institutions.

- Ownership and Control: Foreign investment is allowed in NBFCs under the automatic route, but ownership and control should remain with resident Indian entities.

Documents Required for NBFC Registration

Documentation is a critical part of the NBFC registration process. As of 2024, the following documents are required:

- Certificate of Incorporation: Issued by the Registrar of Companies (ROC) under the Companies Act, 2013.

- Memorandum of Association (MOA) and Articles of Association (AOA): These documents should clearly state the financial objectives of the company.

- Detailed Business Plan: A comprehensive business plan covering at least the next three years, including projected financial statements, market analysis, and growth strategy.

- Directors’ and Shareholders’ KYC Documents: This includes Aadhaar, PAN, passport, and photographs.

- Net Worth Certificate: Certified by a Chartered Accountant (CA), showing that the company has the required NOF of ₹10 crore.

- Credit Reports: Personal credit reports of all directors and shareholders from credit bureaus like CIBIL.

- Bank Account Details: Proof of the NOF being deposited in the company’s bank account.

- Income Tax Returns: The last three years’ income tax returns of the directors.

- Audited Financial Statements: The company’s balance sheet, profit & loss account, and auditor’s report for the last three years (if applicable).

Step-by-Step NBFC Registration Process in 2024

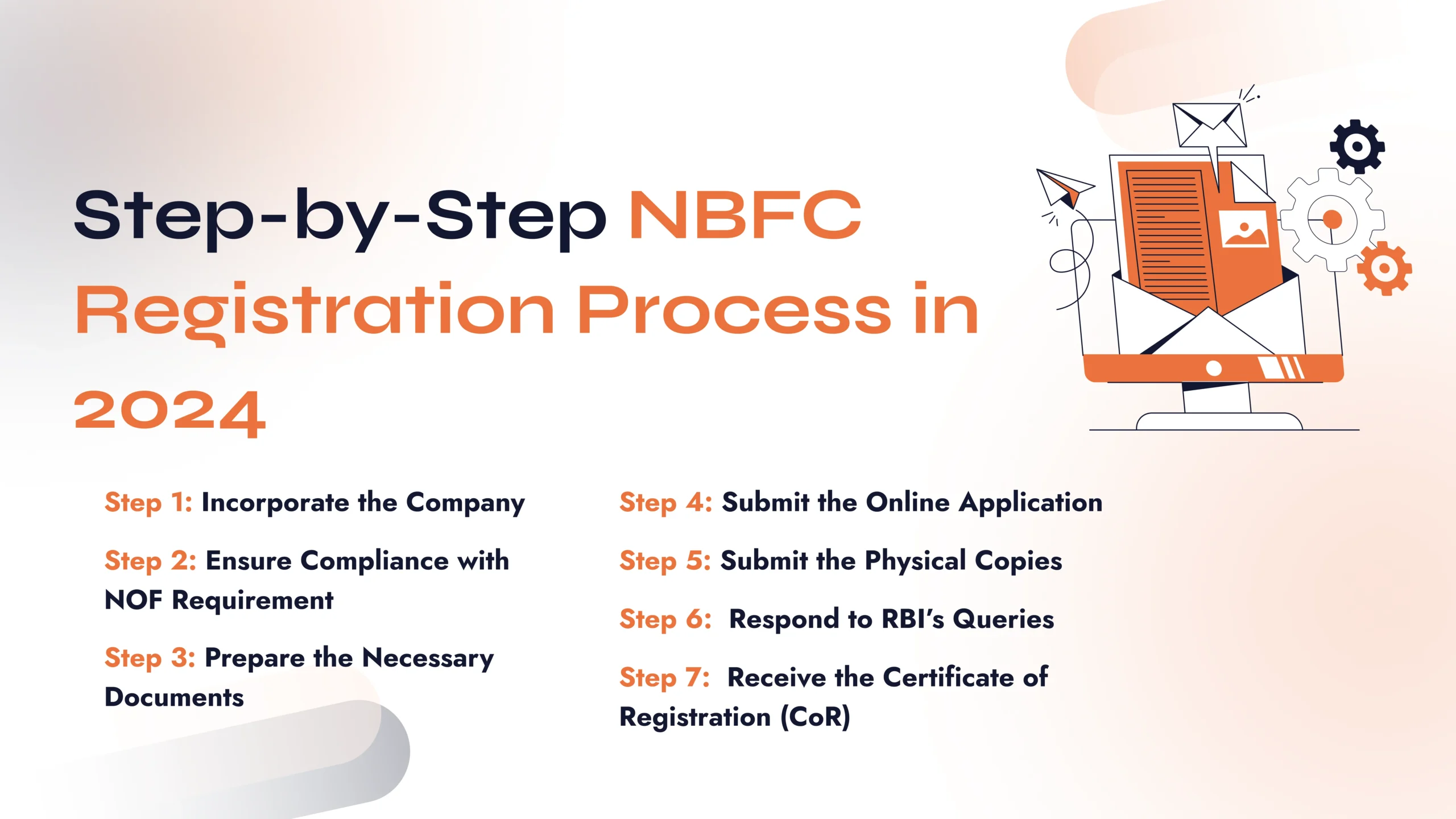

Here’s a detailed breakdown of the NBFC registration process in 2024:

1. Incorporate the Company

The first step is incorporating a Private or Public Limited Company under the Companies Act, 2013. The company name should reflect its financial nature, as per the naming guidelines provided by the Ministry of Corporate Affairs (MCA).

2. Ensure Compliance with NOF Requirement

Deposit the minimum NOF of ₹10 crore into a bank account under the company’s name. This amount will be locked in until the RBI grants the Certificate of Registration (CoR).

3. Prepare the Necessary Documents

Gather all required documents, including the business plan, NOF certificate, and KYC documents. Make sure all documents are duly signed, notarized, and attested where necessary.

4. Submit the Online Application

Submit the application through the RBI’s COSMOS portal. You’ll need to upload all the required documents electronically and pay the applicable fee.

5. Submit the Physical Copies

Send hard copies of the application and all documents to the regional office of the RBI. Ensure that the documents are submitted in the prescribed format.

6. Respond to RBI’s Queries

During the review process, the RBI may request additional documents or clarifications. Promptly responding to these queries is crucial to avoid delays in the registration process.

7. Receive the Certificate of Registration (CoR)

If the RBI is satisfied with your application, you will receive the Certificate of Registration, allowing you to operate as an NBFC in India. This certificate must be prominently displayed at your place of business.

Licenses and Approvals Required for NBFCs

Apart from the RBI’s Certificate of Registration, certain NBFCs may require additional licenses based on their business activities. These include:

- NBFC-MFIs (Microfinance Institutions): Require special approval to offer microfinance services.

- NBFC-Factors: Need to register as Factors under the Factoring Regulation Act, 2011.

- NBFC-Investment and Credit Companies (NBFC-ICC): May need approvals if they engage in credit activities like issuing credit cards or offering loans against securities.

Benefits of NBFC Registration

Registering as an NBFC offers several advantages:

- Wider Market Access: NBFCs can cater to a broader market, including underserved segments like MSMEs and the unbanked population.

- Flexible Operations: NBFCs have fewer operational restrictions compared to banks, allowing them to innovate and offer customized financial products.

- Growth Potential: With India’s growing economy, NBFCs have significant growth opportunities, especially in lending, asset management, and microfinance.

- High Returns: Given the high demand for financial services, especially in rural and semi-urban areas, NBFCs can generate substantial returns on investment.

Challenges in NBFC Registration

While the benefits are significant, there are also challenges:

- Stringent Regulatory Compliance: NBFCs must comply with numerous RBI guidelines, including regular audits, reporting, and adherence to capital adequacy norms.

- High Capital Requirement: The initial NOF of ₹10 crore and ongoing capital requirements can be a barrier, particularly for small businesses.

- Operational Risks: NBFCs face various operational risks, including credit risk, liquidity risk, and market risk, requiring effective risk management strategies.

- Competition: The financial sector is highly competitive, with NBFCs competing against banks, fintech companies, and other financial institutions.

Conclusion: The Importance of Professional Guidance

Registering an NBFC in India offers numerous opportunities but comes with its set of challenges. The process involves strict compliance with regulatory requirements, and missing out on any detail can lead to significant delays or rejection of the application.

Therefore, it is crucial to seek professional guidance to navigate the complex registration process efficiently. With expert assistance, you can ensure that your NBFC is set up correctly and is well-positioned to thrive in India’s dynamic financial landscape.

By understanding the updated eligibility, documentation, and procedural requirements, as well as the benefits and challenges of NBFC registration, you can make informed decisions that align with your business goals. As the financial landscape continues to evolve, staying informed and prepared will be key to your success in the NBFC sector.