NBFCs (non-banking financial companies), unlike other banking institutions they don’t adhere to banking regulations but are regulated by Reserve Bank of India and are registered institutes under the companies act 1956 or Companies Act 2013.

In India, there are mainly two kinds of NBFC:

- Depositing accepting NBFCs – regulated by RBI

- Non-deposit accepting NBFCs – other financial sector regulators

Advantages of NBFC Registration in India

- Provides loans and other credit options

- NBFCs are more profitable than private and public sector banks because of less investment.

- The registration process is simpler than other banks or lending institutions

- Loan processing feature takes lesser time as compared to banks

- NBFCs helps in managing portfolios of stock and shares

- Helps to trade in money market instruments

- CIBIL or credit score does not become hindrance in getting loan

Financial Companies NOT requiring NBFC License

Companies exempted from NBFC registration or don’t require an NBFC license as they regulate by other financial sector regulators –

- Housing Finance Companies – National Housing Bank,

- Insurance Companies – Insurance Regulatory and Development Authority of India (IRDA),

- Chit Fund Companies – respective State Governments,

- Stock Broking – (SEBI) Securities and Exchange Board of India,

- Companies that run Collective Investment Schemes – SEBI,

- Merchant Banking Companies – SEBI,

- Mutual Funds – SEBI,

- Venture Capital Companies – SEBI,

- Nidhi Companies – by Ministry of Corporate Affairs (MCA).

How to Register as NBFC?

Step 1: Register a company under the Companies Act 2013 or 1956.

Step 2: Business financial plan for at least 5 years

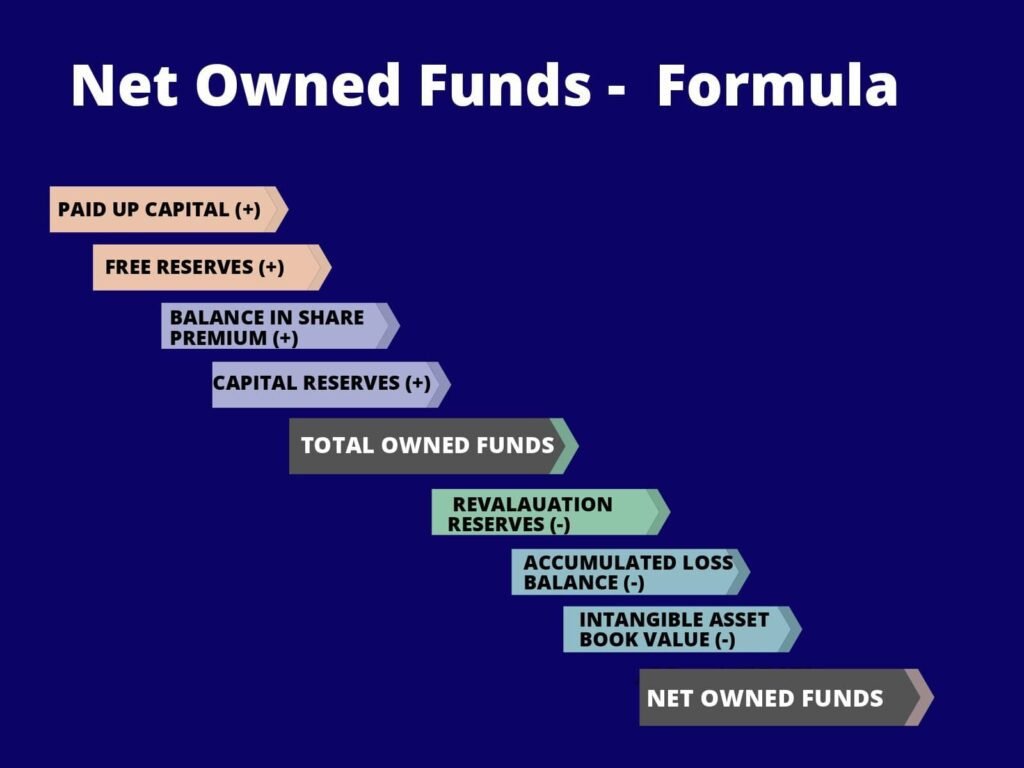

Step 3: Minimum Net Owned Funds (except for NBFC-MFIs, NBFC-Factors and CIC) should be Rs. 2 crores. Along with minimum assets should be worth Rs. 200 crores or above

Step 4: Must comply with the capital compliance and FEMA

Step 5: There should be atleast one director in the company from the same background, or one-third of directors should have financial experience

Step 6: A proof of good CIBIL score is requires to register as NBFC.

Step 7: Next, visit RBI’s official website and fill in the application form.

Step 8: Submit all the required documents along with the application form.

Step 9: Once you have submitted the application form, a CARN number will be generated.

Step 10: Send application copy to the regional branch of RBI, along with all attachments– Capital test, Profile of the promoters, High-level business plan, and Area of operation.

Documents for NBFC Registration -

- Certificate of Company Incorporation.

- Information about management with a brochure of the company.

- Company’s PAN/Corporate Identity Number (CIN) hard copy.

- Office location and address documents.

- Documents like Articles of Association (AoA) and Memorandum of Association (MoA).

- Director’s duly signed each other’s profile.

- CIBIL/credit reports of the Directors.

- A copy of the board resolution that certifies the company will not carry out any activity until the registration is granted from RBI.

- Resolution on the “Fair Practices Code” by the board.

- Certificate by statutory auditor stating – the company will not hold public deposits or accept them.

- Information regarding bank account, balances, loans, credits, etc.

- Audited balance sheet and P&L statement along with the director’s and auditors’ report of three years, if applicable.

- Copy of bank statements and Income Tax Returns.

- Information detailing the company’s plan, generally for the next 3 years, along with the forecasted balance sheets, cash flow statements and income statements.

Calculating Net Owned Funds as per RBI Definition- a formula

Operational manual

Customer KYC Policy:

In order to maintain transparency and safeguard NBFC and banks from fraudulent customers- RBI directs financial institutions to follow KYC(know your customer) procedure – which helps to monitor malicious transactions like money laundry activities and further reports to applicable authorities. It includes- ID, face, biometric verification and document verification of utility bills as resistance proof. Its compliance responsibility rests with the banks not customer.

Anti-Money Transaction/ Laundering:

To make illegally obtained money legally accepted- anti-money laundering (AML) takes place under the observation of FATF (financial action task force) – operated by DBOD (Department of Banking Operations and Development) and RBI.

All NBFC and regular banks need to comply with the benchmark set up by FATF as it’s crucial to keep the international financial relations.

Customer Acceptance Policy:

It’s a document which defines the basis of an NBFC to enter into a relationship with a customer.

It includes:

- Banks must avoid opening an account with false name or details.

- Customer classification based on risks and other factors such as payment mode, location, business activity, annual turnover, etc.

- Time-to-time documentation per the Reserve Bank of India guidelines and PML Act, 2002.

- Needed checks before opening a new bank account.

- If a customer acts on behalf of another person, it duly needs to spell out clearly.

- Bank cannot close or open the account in case of customer insubordination.

FAQs

You need to get registration done from the Registrar of Companies and obtain a license abiding RBI u/s 45-IA under the RBI Act of 1934.

Approx INR 3.5 lakh is the fee required to register as an NBFC with minimum net funds of Rs. 2 crores.

Search mca.gov.in, and you can get the registration number from the official website after entering your first and last name.

How we can help!

We at NBFC Advisory, with the end-to-end professional assistance in NBFC registration from application filling to registration certificate obtainment – handle everything for your NBFC to kick start!

With 15+ years of experience in advisory and counselling —our team of professionals is your one-stop solution for NBFC-related requirements and needs.

Book a call today!