Inside This Article

The fintech revolution is transforming how people access credit, loans, and financial services in India. With an increasing number of digital lending platforms, credit assessment and risk management have become critical for fintech startups.

One of the most effective ways fintech companies can enhance their lending capabilities, reduce risk, and scale their operations is by partnering with credit bureaus such as CIBIL, Equifax, Experian, and CRIF Highmark. These partnerships enable fintech to access credit scores, analyze borrower history, and improve lending decisions.

In this blog, we’ll explore:

- Why fintech startups should collaborate with credit bureaus

- The benefits of credit bureau partnerships

- How to build a successful partnership with credit bureaus

- The regulatory framework & compliance

Why Do Fintech Startups Need Credit Bureau Partnerships?

The Challenge: Fintech startups often struggle with borrower credit assessment, as many applicants are new-to-credit (NTC) or have limited financial histories. Without access to reliable credit data, fintech lenders may:

- Approve high-risk borrowers, leading to loan defaults

- Reject potential good borrowers, limiting their customer base

- Face higher fraud risks and non-performing assets (NPAs)

The Solution: By partnering with Credit Information Companies (CICs), fintech startups can:

- Analyze borrower risk profiles before approving loans

- Offer personalized loan terms based on creditworthiness

- Reduce loan defaults & optimize risk-based pricing

- Enhance user experience by offering instant loan approvals

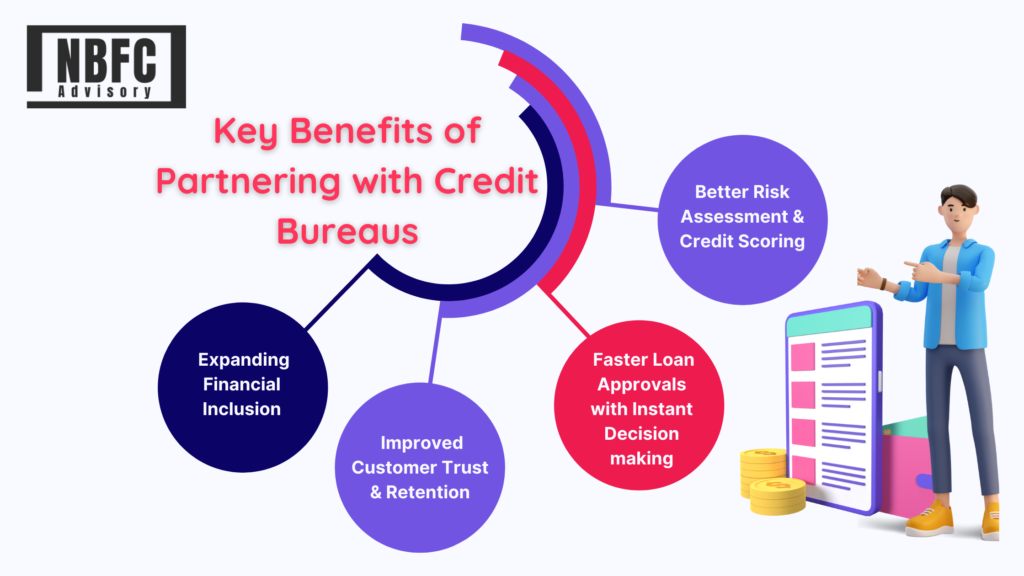

Key Benefits of Partnering with Credit Bureaus

Better Risk Assessment & Credit Scoring

- Access real-time credit reports & analyze borrower payment history.

- Identify high-risk vs. creditworthy applicants using bureau data.

- Improve loan underwriting & reduce NPAs.

Faster Loan Approvals with Instant Decision making

- Credit bureau APIs enable real-time loan approvals.

- Fintech can leverage AI & data analytics for faster credit scoring.

- Customers experience quicker, hassle-free lending.

Expanding Financial Inclusion

- Credit bureaus provide alternative credit scoring for first-time borrowers.

- Fintech can serve new-to-credit (NTC) individuals & MSMEs.

- Data insights help in offering customized loan products.

Compliance & Fraud Prevention

- Credit bureau reports help detect fraud, identity theft & fake applications.

- Reduce chances of bad loans & financial fraud.

- Stay compliant with RBI-mandated credit risk assessment norms.

Improved Customer Trust & Retention

- Offering instant credit approval enhances user experience.

- Customers with good credit scores get better interest rates.

- Builds trust & credibility for fintech startups in the lending industry.

How Fintech Startups Can Partner with Credit Bureaus?

Step 1: Identify the Right Credit Bureau Partner

Major Credit Bureaus in India:

- CIBIL (TransUnion CIBIL)

- Experian India

- Equifax India

- CRIF Highmark

Choosing the Right Fit:

- For MSME lending? – CRIF Highmark has strong SME data.

- For consumer credit? – CIBIL is widely used for personal loans.

- For fraud detection? – Equifax offers risk & fraud analytics.

- For real-time data insights? – Experian provides API-driven solutions.

Step 2: Apply for Credit Bureau Membership

- Fintech startups must register as a Credit Institution (CI) with a credit bureau.

- Submit business details, financial documents & regulatory approvals.

- Get RBI authorization if required.

Tip: Some credit bureaus provide custom API solutions for fintech, making integration easier.

Step 3: Integrate Credit Bureau APIs for Real-Time Credit Checks

API Integration Benefits:

- Automate credit score retrieval & loan approvals.

- Provide instant eligibility checks & pre-approved loan offers.

- Offer customized interest rates based on borrower credit history.

Tech Stack Required:

- REST APIs for real-time credit pulls

- AI/ML models to analyze credit trends

- Secure cloud-based data storage

Step 4: Implement Alternative Credit Scoring

What if a borrower has no credit history?

- Use alternative data sources like mobile payments, bank transaction history, and utility bill payments.

- Leverage AI-based credit scoring models for new-to-credit users.

- Credit bureaus like Experian & Equifax offer alternative scoring solutions for fintech.

Step 5: Ensure Regulatory Compliance

RBI Guidelines for Credit Bureau Partnerships:

- NBFC-Fintech must follow RBI Fair Practices Code (FPC).

- Strict adherence to KYC & AML compliance while accessing credit data.

- Borrowers must provide explicit consent before fetching credit reports.

- Data privacy laws (DPDP Act 2023) require secure storage & handling of credit data.

Important Regulatory Bodies:

- Reserve Bank of India (RBI)

- Financial Intelligence Unit-India (FIU-IND)

- Data Protection Board of India

Future of Fintech-Credit Bureau Partnerships

Emerging Trends:

- AI-powered alternative credit scoring models.

- Open banking integration for real-time financial data analysis.

- Blockchain-based secure credit reporting systems.

- RBI-backed digital lending regulations for fintech.

Fintech startups that embrace credit bureau partnerships will gain a competitive edge in 2025!

How to Get Started?

Book a Compliance Consultation for Seamless Integration! Stay ahead in fintech innovation by leveraging credit bureau partnerships today!

Final Thoughts

Credit bureau partnerships offer a win-win solution for fintech startups by improving risk assessment, reducing defaults, and enhancing customer experience. Fintech must act now to integrate real-time credit insights and AI-driven lending solutions.

Need help with credit bureau integration?

Let’s connect! 📞 Call Us: +91 93287 18979 |

🌐 Visit: nbfcadvisory.com