Inside This Article

When it comes to financial compliance, there are always a lot of questions—and one of the most common ones we hear from NBFCs is: Is CKYC mandatory for us?

The Central Know Your Customer (CKYC) system has simplified the KYC process for financial institutions, making it easier to verify customer identities and reduce fraud. However, while banks must follow CKYC norms, the situation for non-banking financial companies (NBFCs) isn’t always so clear. In this blog, we’ll break it all down for you:

- What CKYC is and why it matters for NBFCs.

- The rules and regulations governing CKYC for NBFCs.

- Whether CKYC is mandatory for all NBFCs or only some.

- The benefits and challenges of implementing CKYC.

- How your NBFC can integrate CKYC smoothly.

What is CKYC and Why is it Important?

CKYC is a centralized KYC registry managed by CERSAI (Central Registry of Securitization Asset Reconstruction and Security Interest of India). It helps financial institutions store and access customer KYC records in a secure, standardized way. Once a customer is registered under CKYC, they receive a 14-digit KYC Identification Number (KIN) that can be used across multiple financial institutions—eliminating the need for repeated KYC verifications.

For NBFCs, CKYC can help prevent fraud, improve risk management, and speed up customer onboarding.

Is CKYC Mandatory for NBFCs? Let’s Break it Down

1. What Do RBI’s Guidelines Say?

The Reserve Bank of India (RBI) has set clear guidelines on KYC and Anti-Money Laundering (AML) compliance, which all financial institutions—including NBFCs—must follow. According to RBI’s Master Directions on KYC, financial entities need to follow certain KYC norms to ensure transparency and reduce financial crimes.

2. Banks vs. NBFCs: Who Must Follow CKYC?

For Banks: CKYC is mandatory—banks must upload and verify customer KYC records in the CKYC registry. For NBFCs: It depends on the type of NBFC. Not all NBFCs are required to follow CKYC, but many are encouraged to adopt it.

3. When is CKYC Required for NBFCs?

- Deposit-taking NBFCs (NBFC-Ds) → Must comply with CKYC norms.

- Systemically Important NBFCs (NBFC-SI) → Required to follow CKYC.

- NBFCs engaged in lending, microfinance, or digital lending → Strongly recommended to use of CKYC for better risk assessment.

- P2P Lending Platforms & Fintech Lenders → Often required to follow CKYC for loan verification.

On the other hand, small NBFCs and non-deposit-taking NBFCs might not be strictly required to follow CKYC, but implementing it can be a smart move.

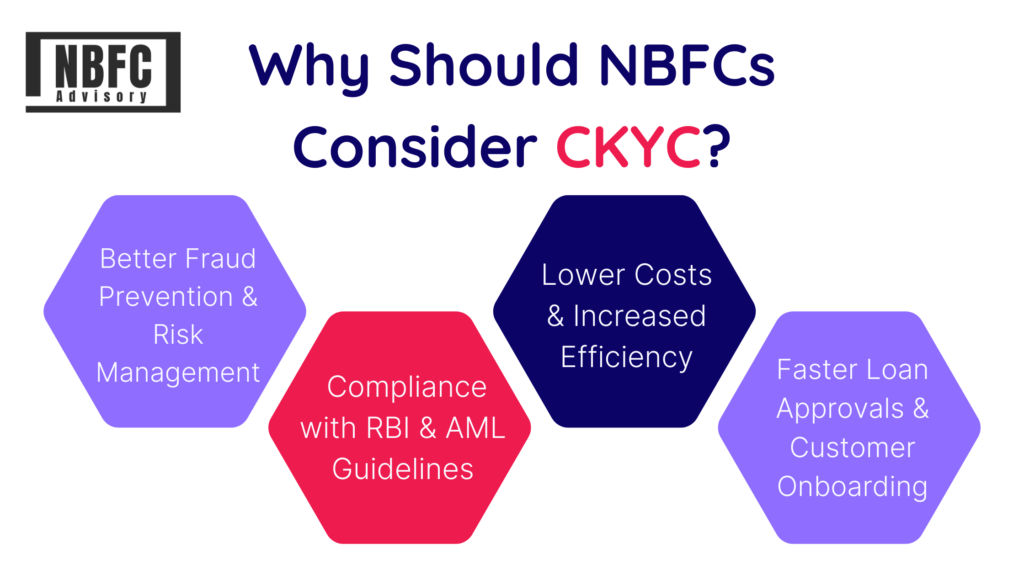

Why Should NBFCs Consider CKYC?

Even if CKYC isn’t mandatory for all NBFCs, adopting it can bring significant advantages:

- Helps detect identity fraud and duplicate KYC submissions.

- Reduces the chances of lending to high-risk customers.

- Strengthens overall due diligence.

2. Faster Loan Approvals & Customer Onboarding

- No need for customers to submit the same documents repeatedly.

- Speeds up the approval process for loans and credit services.

- Enhances the customer experience with quick verification.

3. Compliance with RBI & AML Guidelines

- Ensures your NBFC stays on the right side of regulations.

- Reduces the risk of penalties for KYC non-compliance.

- Makes internal audits and regulatory reporting easier.

4. Lower Costs & Increased Efficiency

- Reduces paperwork and manual KYC verification efforts.

- Cuts down on administrative costs related to compliance.

- Allows your team to focus on growing the business instead of handling redundant KYC processes.

5. Builds Customer Trust

- A seamless, digital KYC process improves credibility.

- Customers appreciate not having to go through repetitive document submissions.

- Encourages long-term customer relationships.

Challenges of Implementing CKYC for NBFCs

While CKYC offers many benefits, there are a few challenges to consider:

- Tech Integration Costs – Smaller NBFCs may need to invest in CKYC-compatible systems.

- Customer Awareness Issues – Many customers are unfamiliar with CKYC and may need guidance.

- Data Security Concerns – Compliance with India’s data protection laws is crucial.

- Regulatory Uncertainty – CKYC requirements are not uniformly applied across all NBFCs, confusing.

How Can NBFCs Implement CKYC?

Step 1: Get Registered as a CKYC-Enabled Institution

- Apply for CKYC registration with CERSAI.

- Submit required compliance and business documentation.

- Gain authorization to access CKYC records.

Step 2: Integrate CKYC APIs for Automated Verification

API Integration Helps:

- Automate KYC verification and retrieval.

- Ensure real-time compliance.

- Reduce manual processing errors.

Step 3: Customer Awareness & Adoption

NBFCs should:

- Educate customers about the benefits and process of CKYC through awareness campaigns.

- Promote CKYC adoption by simplifying onboarding procedures and highlighting its advantages.

Step 4: Strengthen Data Security & Regulatory Compliance

Your NBFC must:

- Follow RBI’s KYC and AML guidelines.

- Ensure secure storage of CKYC data.

- Obtain customer consent before accessing CKYC records.

The Future of CKYC for NBFCs

- RBI may expand CKYC mandates to more NBFCs in the future.

- Digital lenders and fintech NBFCs are leading the CKYC adoption wave.

- AI-powered KYC verification could soon streamline compliance even further.

- Blockchain-based KYC systems might enhance CKYC security.

NBFCs that proactively adopt CKYC will gain a competitive edge in compliance, security, and customer trust.

Final Thoughts: Should Your NBFC Implement CKYC?

While CKYC is not mandatory for all NBFCs, many are finding it beneficial for compliance, fraud prevention, and efficiency. If your NBFC is involved in lending, microfinance, or digital financial services, CKYC can be a game-changer.

Need expert guidance on CKYC compliance? We’re here to help!

📞 Call Us: +91 93287 18979 | 🌐 Visit: nbfcadvisory.com