Inside This Article

Introduction

The Demonization and rise in digital payments paved the way for digital banking units (DBUs) in India, and the RBI’s Digital Payments Index (DPI) has increased to 349.30 in March 2022 from 153.47 in March 2019.

Many banks are now prioritizing incorporating DBUs in their overall banking system because it helps them with more excellent geographical coverage without any fixed setup.

With this, the government is also now aiming to provide maximum services with minimum infrastructure – and DBUs benefit from greater financial inclusion and enhance the banking experience for citizens via remote convenience.

Moreover, PM Modi pointed out the two areas where DBUs will be playing a crucial role. First — reforming, strengthening, and transparency. And second — financial inclusion and participation.

So it’s gaining heat! Now let’s know the “Why” by delving into the blog.

What are DBUs?

As per the Reserve Bank of India (RBI) definition, DBU is “a specialist fixed point business unit/hub with minimal digital infrastructure for offering digital banking products and services as well as servicing existing financial products & services remotely, in both self-service and assisted mode.”

Basically, they are small outlets equipped with tablets and internet services to aid individuals and small businesses with a variety of digital banking solutions.

How are DBUs introduced?

One of the major reasons DBUs have been introduced is the need for modification in the banking system — thus, upgrading it with technology and increasing the availability of banking services for the general public.

According to RBI’s notification dated April 7, 2022, on the inauguration of Digital Banking Units, all Scheduled Commercial Banks (excluding Regional Rural Banks, Local Area Banks & Payments Banks) can opt insourced or outsourced model for incorporating DBU services.

Furthermore, Honourable Prime Minister Narendra Modi recently inaugurated 75 Digital Banking Units (DBUs), intending to provide last-mile accessibility to banking services.

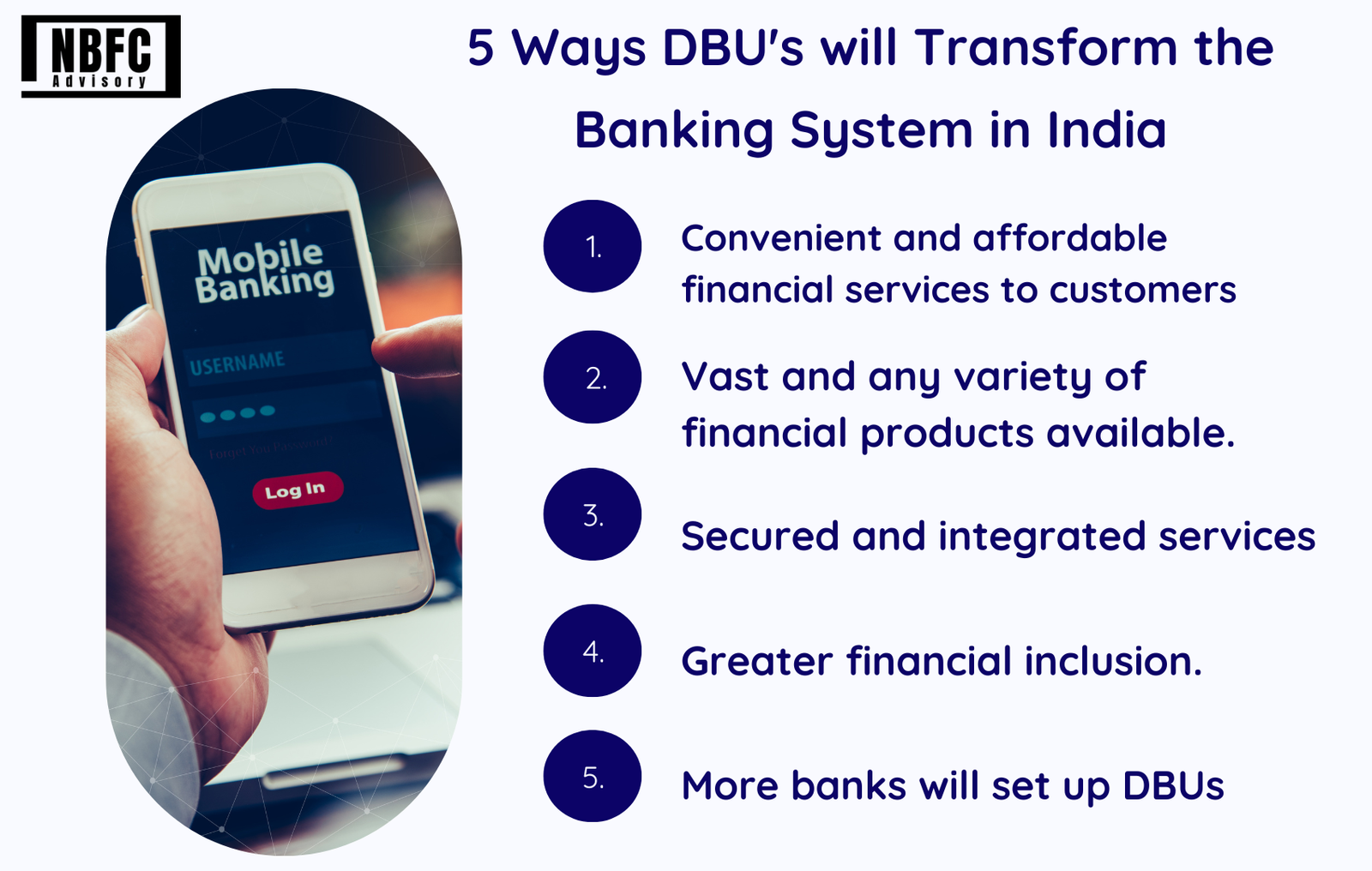

5 ways DBUs will transform the banking system in India

With the increasing innovation and technological installment – DBUs will offer more convenient services for their customers and pave economic increment for India and society. So without further ado, let’s discuss each one of them.

1. Convenient and affordable financial services

As we were discussing, the success of DBUs lies in the convenient service it provides to society and customers.

With this statement, DBUs have been offering various digital banking services cost-effectively as it incurs less fixed costs, uses paperless systems — and, most importantly — fosters greater security measures and data integrity with the robust high-tech structure. And that’s how it’s receiving the hype among finance people and banks.

The RBI governor Shaktikanta Das also added, “The DBUs will augment our efforts to promote financial inclusion by providing banking services in a paperless, efficient, safe, and secure environment.”

2. Vast and any variety of financial products

With convenient locations, it doesn’t mean DBUs lag behind in providing vast and skilled services to customers.

It covers and offers services such as — opening of savings accounts, balance checks, print passbooks, investment in fixed deposits, transfer of funds, loan applications, stop-payment instructions for cheques issued, application for credit/debit cards, view statements of account, pay taxes, pay bills, make nominations, etc.

Moreover, the governor of RBI again added the specific financial services to be provided by the DBUs, including savings, credit, investment, and insurance. On the credit front, the DBUs will provide end-to-end digital processing of small ticket retail and MSME loans, beginning from online applications to disbursals.

With this, DBUs will also facilitate onboarding to Government credit link schemes through the Jan Samarth portal.

3. Secured and integrated services

With financial services, there comes fewer security assurances as banking systems are prone to more malicious cybercriminals and malware.

The top job to do is to ensure all the kept customer data is secured and safe within DBUs.

With connected and integrated channels to ease payment transactions, the need to use Robust technologies is not sanctioned. It is obvious — and DBUs have been enforced well via regular models as banks such as PoS, ATMs, CRMs, Internet Banking Kiosks, e-KYC kiosks, etc.

And if the malware happens, customers can easily seek redressal services with nil worries. Sated by RBI’s guidelines – “There should be an adequate digital mechanism to offer real-time assistance and redress customer grievances arising from business and services offered by the DBUs directly or through Business Facilitators/Correspondents.”

4. Greater financial inclusion

With technological advancement, DBUs have given a gift to the people who don’t

have connectivity to banks to this date.

With the greater reach and paperless bank transactions, bank staff will be available to help and guide users for banking transactions in assisted mode. Plus, it will help harness digital financial literacy and create awareness for adopting digital banking. Thus, inspiring customers and businesses to indulge with banks more than ever for financial stability and success.

Also, the government has announced plans to launch DBUs and involve Rural, urban, and tier-iii cities; coverage – Karnataka, Tamil Nadu, Uttar Pradesh, Odisha, and Rajasthan will get four DBUs each.

This will be followed by Gujarat, Kerala, Madhya Pradesh, Maharashtra, Punjab, Sikkim, and Telangana, with three DBUs each.

5. More banks will set up DBUs

Last but not least, the assistance Digital Banking Units have given to banks is now they can set up more branches.

So, it’s growing – On 12 October, the State Bank of India (SBI) inaugurated maximum DBUs. The Bank of Baroda follows it with eight DBUs and six units by Union Bank of India.

Apart from the public sector banks, two private lenders, ICICI Bank and HDFC Bank have also announced that they will launch their own DBUs.

The products and services in these Units will be provided in two modes, namely, self-service and assisted modes, with the self-service way being available on a 247365 basis.

The banks are also free to engage the services of digital business facilitators and business correspondents to expand the footprint of the DBUs.

The bottom line is: With the technological development and increasing trust of the masses in the digital payment system and DBU’s — will eventually boost its success and growth further.

FAQs

1. What is the future of digital banking in India?

RBI’s making continuous efforts and regulations on neo banks and fintech companies — issuing amendments and new laws regarding transparent and convenient financial transactions. As well as elevated customer experience via Artificial Intelligence (AI) and Machine Learning (ML) based customization of services is gaining the heat by digital banking software. That all sums up the financial trends in the new future.

2. Why is digital transformation imperative in the Indian banking system?

The biggest reason is to provide enhanced customer experience and safely invest resources, thus making better utilization with reduced costs and increasing overall efficiency — leaving banks with no option but to incorporate modern technology.

3. What are the new trends in digital banking?

The effects of Personalization, Digitization, AI for More Targeted Services, Automation, Data-Driven Approach, Cloud Computing, and Real-Time Payments is driving change in the fintech and finance industry. You can also get this with one-click access.