Trends in NBFCs are changing simultaneously with the technology change. NBFCs have been increasing for the past few years and have reached an all-time high growth.

According to a publication by RBI, their credit intensity measured by the credit/GDP ratio has increased from 8.6 in 2013 to 13.7 in 2021.

Moreover, compared to Scheduled Commercial Banks (SCBs)’s credit, their credits have also risen significantly. In this blog, you are going to get more insights into the trends in the NBFC sector.

Reasons for NBFCs’ rapid growth

NBFCs, i.e., Non-Banking Financial Companies, are increasing because of their customer-centric business model. They have better and faster credit disposal mechanisms, an understanding of regional dynamics, great emphasis on data analysis, and low transaction costs.

Also, the utilization of technology in NBFC is there to a great extent and in every possible sphere. All these factors provide them a competitive edge over Scheduled Commercial Banks.

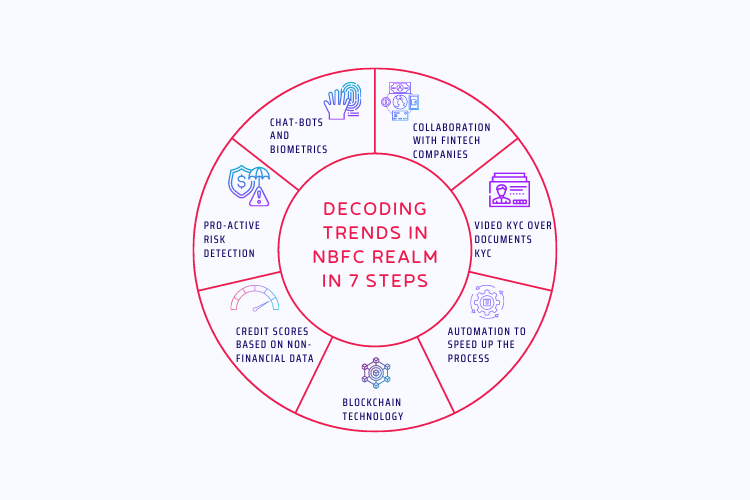

7 game-changing trends in NBFC

Let’s now decode the trends in NBFC, making them even more preferable over SCBs. Here is the list.

- Collaboration with FinTech Companies

Online NBFC in India is collaborating with FinTech companies in a large number. Both the NBFCs and FinTech Companies are gaining from this collaboration.

Fintech companies can access credit easily and scale up, while NBFCs can increase their lending potential and footsteps in the market through existing assistance from established fintech brands.

- Video KYC over documents KYC

The next trend in the NBFC sector is to replace KYC through documents with video KYC. Identity frauds still happen in large numbers even though various measures are in place.

Video KYC will be a great tool to prevent these frauds as there will be videos of customers showing their documents themselves.

- Automation to speed up the process

When it comes to speeding up and scaling the lending process, automation comes as a great tool. Various procedures can be set up pre-defined through automation, and an SOP can be established. Thus, lesser operating costs and higher ROIs.

- Blockchain Technology

The next big trend in NBFC is the use of blockchain technology. Through blockchain technology in NBFC, the customers’ data will not be centralized and can be accessible to the required party after obtaining consent.

Online NBFCs in India can use this data to broaden their customer base and make several services hyper-personalized per the target market and group.

- Credit scores based on non-financial data

Digital payments have increased manifold in India. Online NBFCs in India can use the data of digital payments to gauge credit scores instead of traditional ones, which lack data.

Non-financial data sources such as mobile applications have been set up as revolutionary credit scoring models.

- Pro-active risk detection

Because NBFCs highly utilize technology in their favor, it also has to upgrade their risk detection mechanisms and, thus, IT control. They must be proactive in risk detection rather than reactive to keep their data safe and secure.

- Chatbots and biometrics

Innovation in NBFC has become a constant thing. NBFCs employ chatbots to make the enquiring and lending process for new customers interactive and accessible.

Another trend in NBFC is to use biometrics like iris patterns, fingerprints, retina, etc., to authenticate the customers. This highly reduces identity fraud.

How we can help!

NBFCs are showing more excellent results, whether its growth or personalized services. Customers are hitting the utmost satisfaction level with technology-enabled financial services. With proper study and analysis, your business can also hop on trends to churn the maximum benefits.

We at NBFC Advisory, with 15+ years of experience in advisory and counseling – are assisting businesses to know the market and related trends. Hence, they march forward with projected steps and, thus, elevate their ROIs.

With insights and strategic deployment —our team of professionals is a one-stop solution, so you never miss an opportunity.

Book a call today!

FAQs

According to the RBI guidelines of NBFC, a Non-Banking Financial Company is a company registered under the Companies Act 1956. It engages in the business of loans and advances and acquires shares, debentures, or other marketable securities but cannot accept customer demand deposits. It also does not form a part of the payment and settlement system.

Fintech Companies are those companies that provide financial services to customers through the integration of technology. They use various software to make financial assistance easier, faster, and more efficient. They use advanced technology like machine learning, data science, blockchain, etc., to streamline their entire process.

The finance industry has become more transparent, efficient, faster, and secure because of the integration of blockchain and fintech. These made the finance-related processes streamlined, authentic, and programmable.

According to the current scenarios of NBFCs in India, NBFCs will capture more share in the Indian market. There is still a wide gap between credit demand and supply in India, and also, there is an increase in start-up culture which will grow the need for credit even more.